Germany Tour Operator Software Market to Double by 2032: Digital Transformation, Personalization, and AI Drive 7.79% CAGR Growth

1. Market Overview

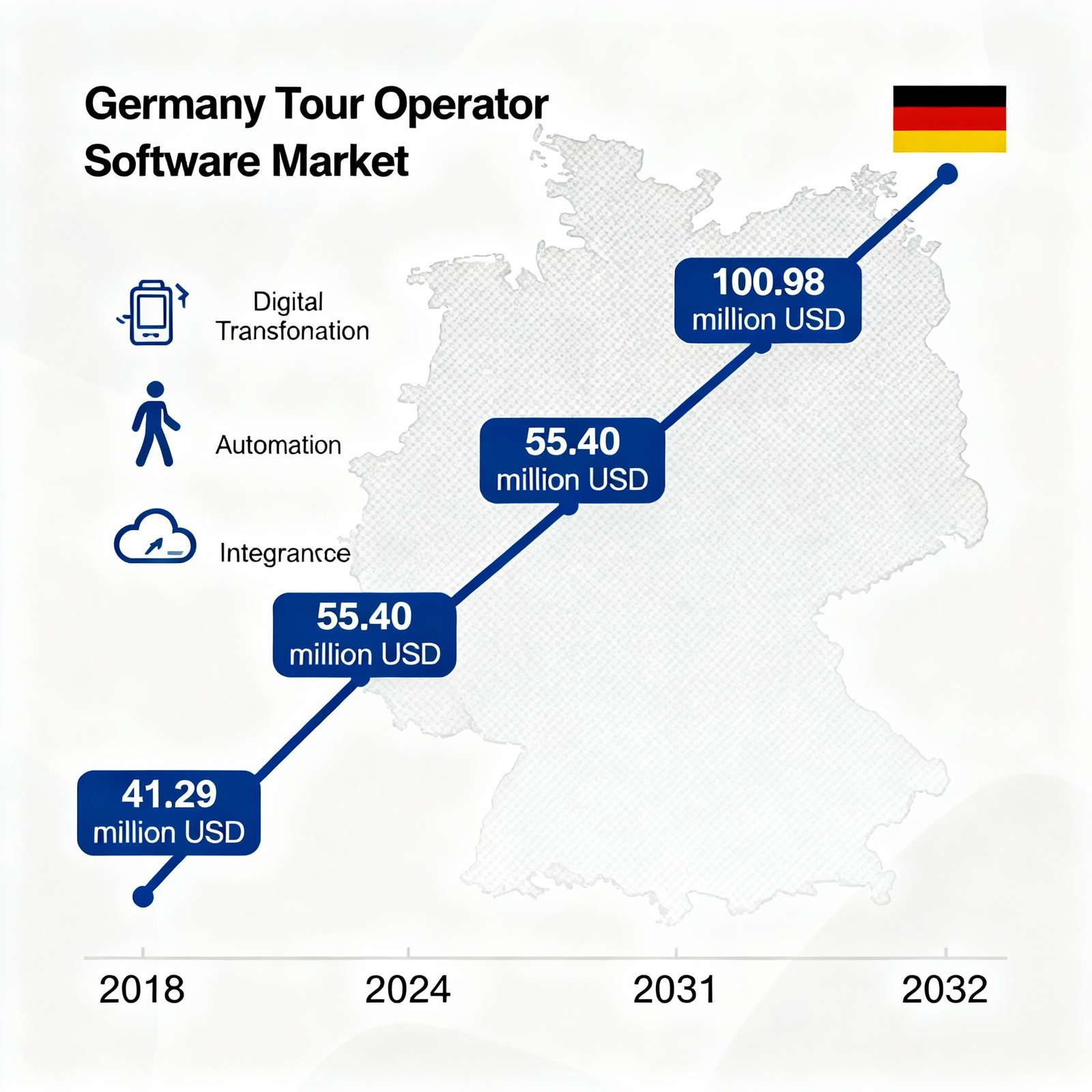

The Germany Tour Operator Software Market has been on a steady upward trajectory, driven by rapid digital transformation and the growing need for customer-centric travel solutions. According To Credence Research,Valued at USD 41.29 million in 2018, the market expanded to USD 55.40 million in 2024, and projections indicate it will reach USD 100.98 million by 2032, registering a CAGR of 7.79% during the forecast period (2024–2032).

This growth reflects the nation’s strong tourism infrastructure, technological maturity, and the proactive adoption of automation tools by travel businesses. Germany’s digital-first approach in tourism, bolstered by initiatives such as “Digital Jetzt,” continues to strengthen the position of domestic operators in the global travel technology ecosystem.

The ongoing demand for streamlined workflows, cloud integration, and enhanced traveler experiences has pushed software adoption to new heights. The market’s evolution is not only driven by technological innovation but also by a fundamental shift in how travelers plan, book, and experience their journeys.

2. Regional Landscape: Germany’s Strong Position in Europe’s Travel Tech Ecosystem

Germany has emerged as one of Europe’s leading hubs for travel technology. The country’s mature tourism infrastructure, robust digital connectivity, and concentration of leading tour operators make it a focal point in the European market.

In 2024, Europe accounted for 36% of the global tour operator software market share, followed by North America (28%) and Asia Pacific (24%). Germany’s strong contribution within Europe is attributed to the following factors:

- Northern and Western Germany lead adoption due to major international airports and the presence of large travel agencies.

- Eastern Germany is experiencing rapid growth, driven by government support for digitalization initiatives.

- Secondary cities are emerging with niche travel solutions tailored for local markets, creating opportunities for smaller software vendors.

This regional diversity ensures a balanced market landscape where innovation, sustainability, and customer experience drive progress.

Source:

https://www.credenceresearch.com/report/germany-tour-operator-software-market

3. Market Segmentation Insights

The Germany Tour Operator Software Market can be segmented by component, deployment, end-user, and functionality.

By Component

- Software (61% share in 2024): Includes booking management, payment processing, CRM, and automation platforms.

- Services (39% share in 2024): Encompasses integration, customization, data migration, and technical support services.

The software segment dominates due to the industry’s focus on end-to-end automation and operational transparency. Meanwhile, the services segment continues to grow, supported by SMEs seeking tailored and scalable implementations.

4. Key Market Drivers

a. Rising Digital Transformation Across the Travel Industry

Digitalization remains the cornerstone of growth in Germany’s tour operator software ecosystem. Operators are increasingly moving away from manual processes toward cloud-based and AI-powered systems that enhance efficiency and accuracy.

Benefits of digital adoption include:

- Real-time booking synchronization

- Automated invoicing and reporting

- Enhanced customer experience through mobile and web platforms

- Integration of secure payment gateways

- Cost reduction and faster operations

Germany’s “Digital Jetzt” initiative continues to boost the participation of small and medium-sized enterprises (SMEs) in digital transformation, offering grants and technical support for adopting software solutions.

b. Increasing Demand for Personalized Travel Experiences

The modern traveler demands a unique, personalized experience. Tour operators are meeting these expectations through AI-driven analytics and data-based insights that tailor itineraries and recommendations to individual preferences.

Personalization strategies include:

- Dynamic pricing and customized itineraries

- Real-time notifications and multilingual support

- Predictive analytics for future travel recommendations

- AI chatbots for 24/7 customer assistance

This personalization wave has led to higher customer satisfaction, increased loyalty, and improved operational efficiency for German tour operators.

c. Expansion of Online Booking Platforms and Mobile Adoption

The growing penetration of smartphones in Germany has revolutionized travel booking. Consumers expect seamless mobile-first experiences, from planning to payment.

Key developments include:

- Real-time availability updates across mobile platforms

- Integration of mobile wallets and payment gateways

- Location-based recommendations

- Simplified digital check-in and itinerary management

Millennials and Gen Z travelers are driving this trend, as they prefer instant, transparent, and contactless travel solutions.

d. Integration of Cloud-Based and AI-Enabled Platforms

Cloud computing has become the backbone of modern tour operator software. It offers scalability, flexibility, and collaborative functionality between stakeholders -including agents, travelers, and partners.

The combination of cloud and AI delivers the following advantages:

- Predictive analytics for demand forecasting

- Intelligent itinerary planning

- Automated fraud detection and risk mitigation

- Dynamic pricing optimization

- Real-time collaboration and system updates

The result is an agile, efficient ecosystem that supports both large enterprises and small operators.

5. Market Trends Transforming the Industry

a. Growth of Eco-Friendly and Sustainable Tourism Software

Sustainability is becoming a defining factor in Germany’s tourism sector. Tour operators are integrating carbon tracking modules, eco-certifications, and green travel recommendations into their software systems.

Sustainable tourism software helps operators:

- Measure environmental impact

- Offer eco-conscious travel packages

- Align with Germany’s national sustainability goals

Corporate clients increasingly prefer vendors with measurable green policies, prompting software providers to innovate with sustainability-focused features.

b. Increasing Integration with Virtual and Augmented Reality (VR/AR)

Virtual and augmented reality are reshaping travel experiences in Germany. Operators now use VR tours and AR-based guides to allow travelers to preview destinations virtually.

Applications include:

- Virtual site exploration before booking

- AR-enhanced navigation during tours

- Immersive cultural storytelling

- Enhanced accessibility for remote travelers

These technologies also serve as powerful marketing tools, helping operators stand out in a competitive market.

c. Rise of Multi-Channel and Omni-Channel Distribution

Omni-channel engagement is redefining customer interactions. German operators are adopting CRM-integrated software to ensure consistent experiences across websites, social media, and online travel agencies.

Benefits include:

- Broader reach and higher engagement rates

- Consistent branding across all channels

- Improved conversion rates

- Real-time data insights for marketing decisions

This trend strengthens brand loyalty and ensures a seamless user journey, from discovery to booking and post-travel follow-up.

d. Adoption of Subscription-Based and SaaS Pricing Models

Software-as-a-Service (SaaS) has become the preferred pricing model for German tour operators. Subscription-based plans reduce upfront investment and ensure continuous access to software updates.

Advantages include:

- Predictable monthly costs

- Scalability for different business sizes

- Easier upgrades and maintenance

- Improved data backup and security

SMEs especially benefit from SaaS flexibility, while large enterprises leverage custom enterprise packages for greater control.

6. Market Challenges

a. Data Security Concerns and Rising Cyber Threats

With growing data volumes, cybersecurity has become a critical issue. Tour operators handle sensitive information-from payment details to passport data -making them vulnerable to cyberattacks.

Key challenges:

- Rising incidents of data breaches and phishing

- High costs of compliance with GDPR and security certifications

- Resource limitations among small operators

- Customer trust and reputation management

To mitigate risks, operators are increasingly investing in end-to-end encryption, biometric verification, and AI-based threat detection systems.

b. High Competition and Cost Pressures

The market is intensely competitive, with global software giants dominating the landscape. Smaller players face challenges balancing affordability with feature-rich offerings.

Competitive dynamics include:

- Constant innovation pressure

- Price wars and margin reductions

- Difficulty for SMEs to maintain differentiation

- Growing customer expectations for all-in-one solutions

To survive, smaller vendors must focus on niche markets, superior service quality, and value-added features.

7. Market Opportunities

a. Expansion into Niche and Specialized Tourism Segments

Niche markets -such as adventure tourism, cultural experiences, and wellness travel-present high-potential opportunities for German operators. Specialized software modules can handle custom itineraries, flexible pricing, and localized promotions.

Advantages of niche focus:

- Stronger brand identity

- Higher customer retention

- Reduced competition

- Targeted digital marketing

By focusing on niche travelers, SMEs can compete effectively against larger agencies while enhancing profitability.

b. Growing Role of Artificial Intelligence and Predictive Analytics

AI is redefining decision-making and customer engagement across Germany’s tour operator landscape. Predictive analytics helps anticipate travel trends, optimize resource use, and boost marketing performance.

AI-powered features include:

- Demand forecasting and pricing optimization

- Sentiment analysis for customer feedback

- Smart recommendations and chatbots

- Real-time fraud detection

Operators leveraging AI gain a competitive edge through faster responses, accurate predictions, and higher customer satisfaction.

8. Competitive Landscape

The Germany Tour Operator Software Market features a mix of global giants and domestic innovators.

Leading vendors include:

- Travelport

- Travefy

- Checkfront

- Rezdy

- Trawex Technologies

- Tourwriter

These companies are investing heavily in cloud platforms, mobile apps, and AI integration to strengthen their foothold. Local players are also rising, focusing on German-language support, compliance, and localized features to meet specific market needs.

9. Government Support and Regulatory Environment

Germany’s government continues to support digital transformation through programs like Digital Jetzt, Tourismus 4.0, and SME Digitalization Grants. These initiatives encourage technology adoption among small businesses and startups.

Additionally, strict GDPR compliance ensures data privacy and security, fostering greater consumer trust. As sustainability becomes a policy focus, future regulations may include mandatory carbon reporting for travel operators, shaping software requirements accordingly.

10. Future Outlook: The Road Ahead

The Germany Tour Operator Software Market is poised for sustained expansion through 2032. Key growth themes include:

- Increased integration of AI and machine learning

- Rising demand for eco-tourism and green software modules

- Wider adoption of mobile-first and cloud-native platforms

- Enhanced data analytics for traveler insights

- Expansion into cross-border European travel software networks

By 2032, Germany’s market value is expected to surpass USD 100.98 million, nearly doubling within eight years. Tour operators embracing innovation, security, and personalization will remain at the forefront of this transformation.

Conclusion

The Germany Tour Operator Software Market exemplifies how technology is reshaping the travel industry. With a 7.79% CAGR and strong digital foundations, the sector stands at the intersection of innovation, customer experience, and sustainability.

From AI-driven personalization to cloud-based automation and immersive VR tools, the future of tour operation in Germany is intelligent, data-driven, and customer-first. Vendors that align with these trends will not only capture market share but also redefine the travel experience for millions of global and domestic travelers.

Source:

https://www.credenceresearch.com/report/germany-tour-operator-software-market

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness