Biologics CDMO Secondary Packaging Market Scope 2032

Market Overview

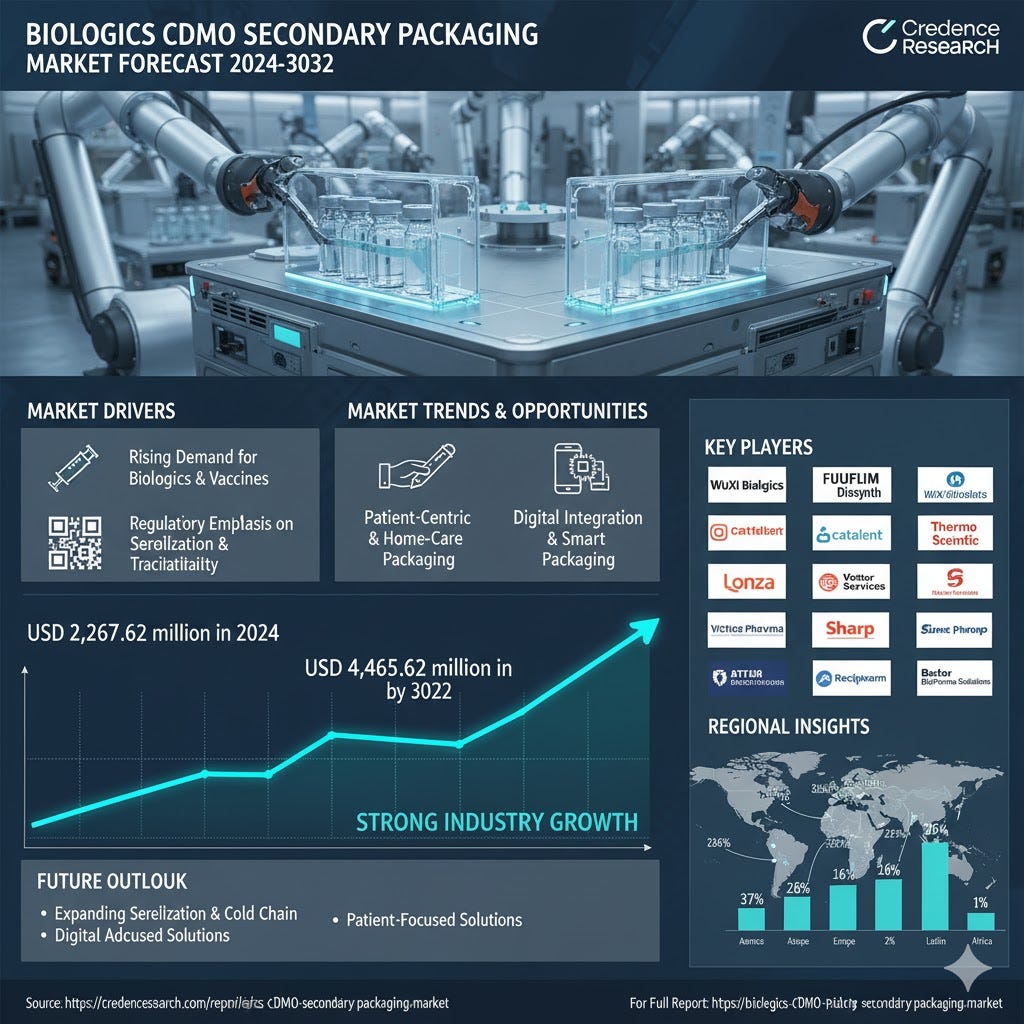

The global Biologics CDMO Secondary Packaging Market was valued at USD 2,267.62 million in 2024 and is projected to reach USD 4,465.69 million by 2032, reflecting strong industry growth, as per Credence Research. The market expansion is driven by increasing demand for biologics and vaccines, necessitating reliable secondary packaging solutions. Leading companies, including WuXi Biologics, FUJIFILM Diosynth, Samsung Biologics, Thermo Fisher Scientific, Catalent, Lonza, PCI Pharma Services, Vetter Pharma, Almac Group, Sharp, and Recipharm, dominate through advanced serialization, cold chain packaging, and patient-centric kitting solutions. North America leads with a 37% share, supported by strong outsourcing and regulatory compliance.

Source: https://www.credenceresearch.com/report/biologics-cdmo-secondary-packaging-market

Market Drivers

Rising Demand for Biologics and Vaccines

The Biologics CDMO Secondary Packaging Market benefits from an expanding pipeline of biologics and vaccines. It experiences high demand due to the prevalence of chronic diseases and infectious outbreaks, driving large-scale production of injectable therapies. It ensures product integrity through boxes, vials, prefilled syringes, and cold chain solutions. CDMOs provide scalable, compliant secondary packaging tailored for diverse biologics, supporting global distribution. The sector leverages pharmaceutical outsourcing trends to optimize efficiency. Increasing investment in prefilled and patient-ready formats accelerates market adoption. It also facilitates faster access to emerging therapies, strengthening the supply chain.

Regulatory Emphasis on Serialization and Traceability

Global mandates on serialization, tamper-evidence, and secure labeling significantly influence the Biologics CDMO Secondary Packaging Market. It incorporates advanced packaging technologies into cartons, labels, and kits to enhance supply chain transparency. Track-and-trace requirements across North America, Europe, and Asia-Pacific create substantial opportunities for compliant CDMOs. It drives investment in digital infrastructure and monitoring systems. Serialization adoption ensures anti-counterfeit protection and patient safety. CDMOs can differentiate through regulatory compliance expertise. It also encourages integration of software-enabled solutions for real-time verification across global supply chains.

Market Trends and Opportunities

Shift Toward Patient-Centric and Home-Care Packaging

The Biologics CDMO Secondary Packaging Market is embracing patient-centric solutions. It focuses on integrated kits combining drug, device, and instructions to support self-administration. It improves adherence, reduces dosing errors, and supports healthcare decentralization. Customized formats tailored to patient populations drive flexible packaging demand. It encourages prefilled syringes and cartridge adoption in home-care therapies. The market benefits from growth in outpatient biologics administration. CDMOs invest in innovative packaging to align with patient convenience and safety.

Digital Integration and Smart Packaging Solutions

The adoption of smart packaging technologies is rising across the Biologics CDMO Secondary Packaging Market. It implements QR codes, NFC tags, and embedded sensors to ensure temperature monitoring and product authentication. Digital solutions improve supply chain transparency and regulatory compliance. It strengthens customer engagement and supports anti-counterfeiting strategies. Blockchain-enabled traceability creates market differentiation. Investments in digital serialization infrastructure help capture high-value contracts. It positions CDMOs to respond rapidly to evolving biopharma requirements and patient safety standards.

Market Challenges

High Capital Investment Requirements

The Biologics CDMO Secondary Packaging Market faces high capital expenditure demands. It requires substantial investment in equipment, cold chain infrastructure, and serialization systems. Smaller CDMOs struggle to compete due to entry barriers and cost pressures. It necessitates continual upgrades to meet evolving regulatory standards. Financial constraints limit expansion and scalability for mid-tier players. It also increases operational risk when entering high-volume biologics programs. Maintaining competitiveness requires careful financial planning and strategic partnerships.

Complex Regulatory Landscape Across Regions

Regional regulatory differences complicate operations in the Biologics CDMO Secondary Packaging Market. It navigates fragmented rules across North America, Europe, and Asia-Pacific, including serialization, labeling, and cold chain compliance. It demands continuous monitoring and adaptation to local frameworks. Regulatory complexity affects global distribution timelines and operational efficiency. It necessitates robust quality management systems and compliance expertise. Adherence to multi-region regulations influences client selection and market reputation. It increases costs and operational risk for CDMOs aiming for international expansion.

Key Players

-

WuXi Biologics (Cayman) Inc.

-

Samsung Biologics Co. Ltd.

-

Thermo Fisher Scientific Inc.

-

Catalent, Inc.

-

Lonza Group

-

PCI Pharma Services

-

Vetter Pharma International GmbH

-

Almac Group

-

Sharp (part of UDG Healthcare)

-

Recipharm AB

-

Siegfried Holding AG

-

Baxter BioPharma Solutions

Regional Analysis

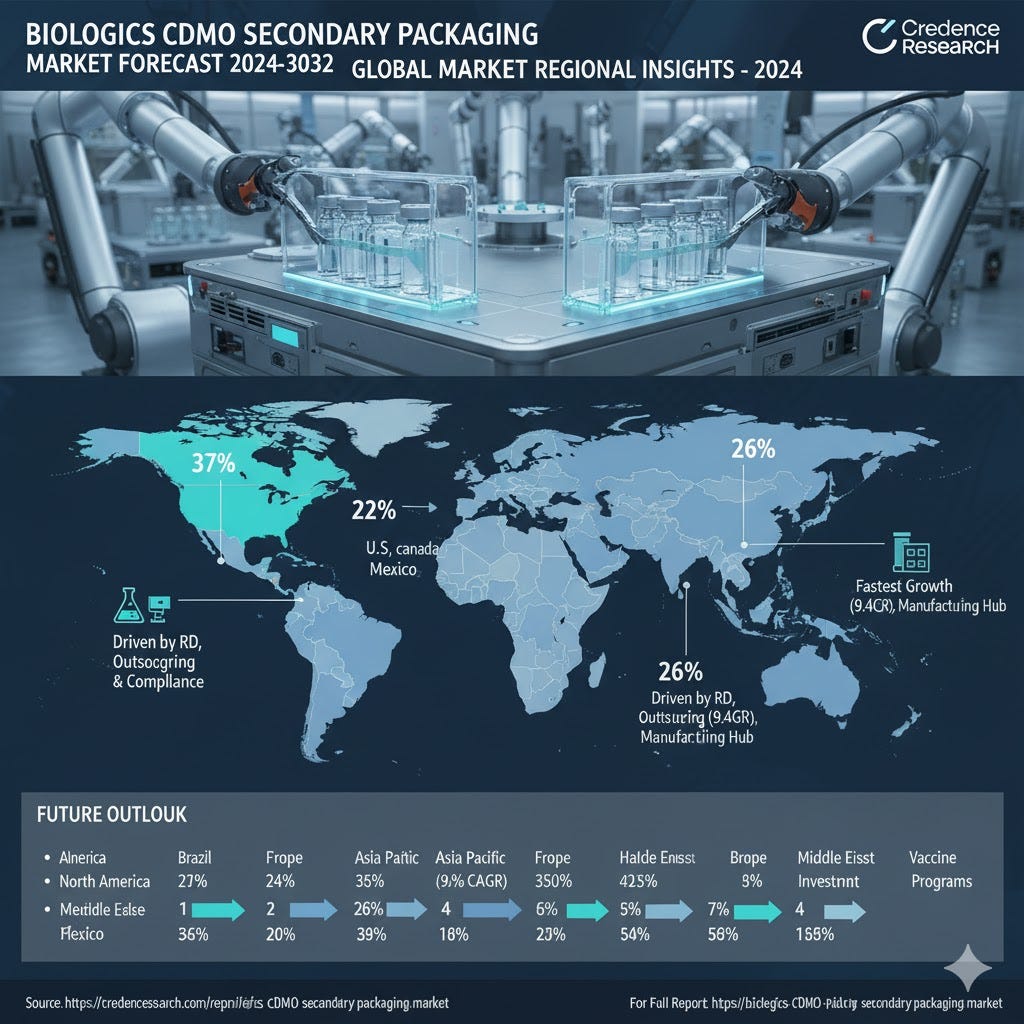

North America (37%)

North America leads the Biologics CDMO Secondary Packaging Market with 37% share in 2024, driven by strong pharmaceutical outsourcing, advanced biologics pipelines, and regulatory compliance. U.S., Canada, and Mexico support growth through R&D and logistics.

Europe (16%)

Europe holds 16% share in 2024, fueled by Germany, France, and the UK’s pharmaceutical base. Strict packaging regulations, serialization, and contract packaging expansion for generics and biosimilars support moderate growth at 7.0% CAGR.

Asia Pacific (26%)

Asia Pacific captures 26% share in 2024, registering the fastest growth at 9.4% CAGR. China, Japan, South Korea, and India drive demand via biologics manufacturing, clinical trials, cold chain infrastructure, and vaccine production.

Latin America (4%)

Latin America accounts for 4% share in 2024, led by Brazil and Mexico. Pharmaceutical manufacturing expansion, CDMO adoption, and cost-effective packaging trends support 6.5% CAGR, with cold chain solutions boosting growth.

Middle East (2%)

The Middle East represents 2% share in 2024. Countries including Saudi Arabia, UAE, and Turkey invest in healthcare infrastructure, serialization, and distribution networks. Growth maintains 5.3% CAGR despite import dependence and limited scale.

Africa (1%)

Africa holds 1% share in 2024, with South Africa and Egypt leading adoption. Vaccine programs, donor-funded initiatives, and cold chain partnerships support steady growth at 4.5% CAGR, gradually expanding biologics packaging capacity.

Go-To Market Strategy

The Biologics CDMO Secondary Packaging Market strategy focuses on expanding offerings in serialization, cold chain solutions, and patient-centric kitting. It leverages partnerships with global biopharmaceutical firms to enhance service portfolios. It invests in digital technologies like smart packaging and real-time monitoring to ensure compliance. It expands in high-growth regions such as Asia-Pacific to capture emerging biologics demand. Customer-centric solutions emphasizing flexibility, innovation, and rapid scalability strengthen market positioning. It aligns operations with regulatory frameworks while targeting specialized services for prefilled syringes, cartridges, and integrated biologics kits. It builds long-term partnerships to secure sustainable growth.

Future Outlook

The Biologics CDMO Secondary Packaging Market will experience strong growth driven by increasing biologics and vaccine demand. Key players such as WuXi Biologics, FUJIFILM Diosynth, Samsung Biologics, Thermo Fisher, Catalent, and Lonza are expanding serialization, cold chain, and patient-centric packaging capabilities. Regional growth in North America, Europe, and Asia-Pacific enhances global reach. Digital adoption improves compliance, traceability, and supply chain transparency. Recent developments, including FUJIFILM’s long-term agreements and facility expansions, support capacity growth. The market outlook reflects sustained investment in innovative packaging, regulatory adaptability, and patient-focused solutions to meet evolving biopharma requirements.

For Full Report: https://www.credenceresearch.com/report/biologics-cdmo-secondary-packaging-market

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness