Market Overview

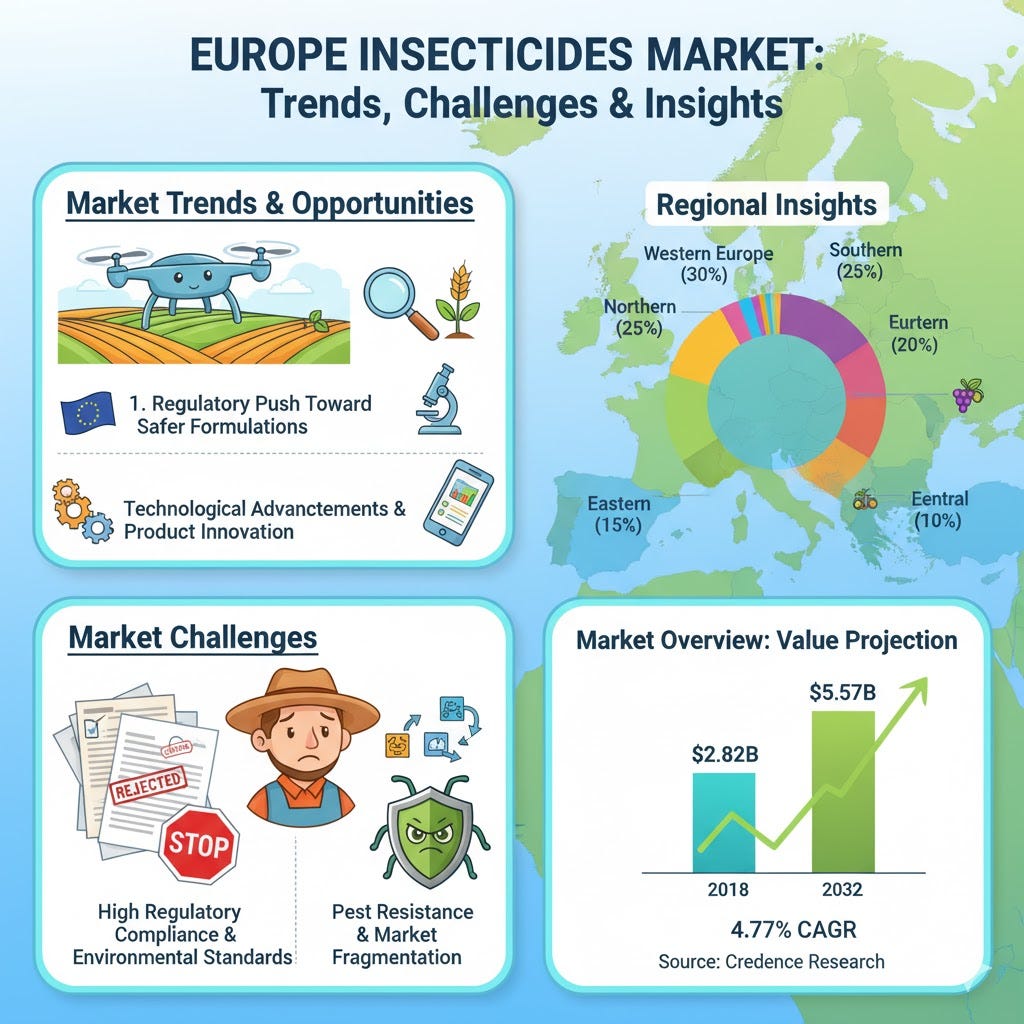

As per Credence Research, the Europe Insecticides Market was valued at USD 2,815.62 million in 2018 and is projected to reach USD 5,569.56 million by 2032, growing at a CAGR of 4.77% during the forecast period from 2024 to 2032. The market expansion is driven by rising agricultural productivity needs, increasing pest resistance, and growing adoption of advanced crop protection solutions. Strong demand for bio-based and environment-friendly insecticides further supports market growth, aligning with strict European regulations promoting sustainable farming practices and reducing chemical residues in agricultural outputs.

Source: https://www.credenceresearch.com/report/europe-insecticides-market

Market Drivers

Rising Agricultural Productivity Needs

The Europe Insecticides Market expands alongside intensive agricultural practices across major economies such as France, Germany, and Spain. It provides farmers with effective pest control solutions to safeguard crop yields and quality. Organophosphates and pyrethroids continue to dominate due to their broad applicability across cereals, fruits, and vegetables. It supports food security and strengthens the region’s export competitiveness. Integrated Pest Management (IPM) adoption complements chemical solutions, reducing pest resistance and ensuring compliance with EU agricultural standards. Continuous product innovation and strong R&D investments sustain growth and address evolving pest management requirements across European farmlands.

Expansion of Integrated Pest Management (IPM)

The Europe Insecticides Market benefits from the growing integration of chemical and biological control measures, crop rotation, and digital monitoring technologies. It helps minimize pest resistance while aligning with EU sustainability objectives. Governments promote the use of eco-friendly insecticides through incentives and regulatory support. It extends the lifecycle of chemical insecticides and encourages sustainable pest control. Farmers gain improved efficiency and compliance with environmental standards. Demand for advanced formulations and precision-based monitoring tools continues to rise. IPM expansion fosters long-term resilience, innovation, and sustainability within Europe’s agricultural ecosystem.

Market Trends and Opportunities

Regulatory Push Toward Safer Formulations

The Europe Insecticides Market is witnessing a strong regulatory shift favoring safer and eco-friendly formulations. EU authorities promote alternatives to banned or restricted chemicals, including certain neonicotinoids. It encourages manufacturers to innovate and develop compliant solutions with minimal environmental impact. This transition opens opportunities for bio-based and organic insecticides tailored for sustainable farming. Demand for digital monitoring technologies enhances precision and effectiveness. It supports integrated chemical-biological approaches aligned with European Green Deal objectives, ensuring pest control efficiency and promoting long-term market expansion.

Technological Advancements and Product Innovation

The Europe Insecticides Market leverages technological innovation to achieve greater efficacy and sustainability. It integrates smart IPM systems, drone-based monitoring, and next-generation bio-insecticides for targeted pest control. Advancements in formulation chemistry enable higher potency against resistant pests with lower toxicity levels. It helps manufacturers maintain competitiveness and expand product portfolios across diverse crops. Precision agriculture technologies support accurate application and reduced wastage. It creates growth prospects in high-value crops such as vineyards, horticulture, and grains. Ongoing innovation reinforces sustainable pest management and compliance with EU standards.

Market Challenges

High Regulatory Compliance and Environmental Standards

The Europe Insecticides Market faces challenges from stringent EU regulations governing chemical formulations and application safety. It must comply with environmental and toxicological standards, increasing R&D and operational costs. Constant updates to EU directives demand close monitoring and product reformulation. Smaller producers experience financial strain in adapting to these requirements. It must balance performance with ecological safety and transparency. Compliance complexities can delay approvals and limit new product introductions. These factors collectively challenge market agility and expansion across member nations.

Pest Resistance and Market Fragmentation

The Europe Insecticides Market contends with increasing pest resistance, reducing the efficacy of conventional chemicals. It necessitates continuous innovation in molecule development and application techniques. Market fragmentation among chemical and biological solution providers creates strong competitive pressures. It must prioritize farmer education for correct product use and IPM adoption. Distribution inefficiencies and supply chain challenges affect regional performance. It also faces difficulties in standardizing bio-insecticide formulations across varied agricultural systems. Continuous research and technological advancement remain vital to sustain effectiveness and maintain market leadership.

Regional Insights

Western Europe (30%): Leads the Europe Insecticides Market with advanced agricultural systems and high cereal and vegetable output.

Southern Europe (25%): Strong growth driven by vineyard, olive, and fruit cultivation.

Northern Europe (20%): Focused on sustainable farming and bio-based insecticide adoption.

Eastern Europe (15%): Rising modernization and growing demand for affordable crop protection.

Central Europe (10%): Expanding through mixed farming and integrated pest management initiatives.

Key Players

Bayer AG

BASF SE

Syngenta AG

FMC Corporation

ADAMA Agricultural Solutions Ltd.

Nufarm Limited

UPL Limited

Sipcam Oxon S.p.A

Cheminova (FMC)

Bioline AgroSciences

Go-To Market Strategy

The Europe Insecticides Market prioritizes eco-friendly formulations aligned with EU sustainability and regulatory frameworks. It strengthens collaborations with distributors, cooperatives, and retailers to improve market reach and awareness. Companies invest in R&D to develop advanced, low-toxicity solutions with high efficacy across diverse crops. It emphasizes digital tools and smart monitoring systems to promote precision agriculture. Educational programs help farmers adopt best practices and comply with EU safety norms. Strategic marketing and innovation-driven approaches enhance competitiveness and long-term adoption across the region.

Recent Developments

2022: BASF introduced Exponus® insecticide for maize and potato crops to target resistant pests.

2023: Bayer launched Movento® insecticide to support horticultural IPM programs.

2024: Growing adoption of digital pest monitoring tools across European farms.

2024: EU regulatory updates promoted rapid transition toward biological and eco-friendly insecticides.

2025: Major companies expanded R&D centers focusing on sustainable insecticide innovation.

Future Outlook

The Europe Insecticides Market will witness strong growth through 2032, driven by sustainable agriculture initiatives and demand for eco-friendly pest control. It will rely on bio-based formulations and advanced digital monitoring systems to improve effectiveness and compliance. IPM adoption will continue to expand across major crop segments. Companies will focus on innovation and R&D to meet evolving EU safety regulations. Strategic collaborations, farmer training, and smart technology integration will enhance efficiency. It will maintain long-term growth by balancing productivity, safety, and sustainability across the European agricultural landscape.

Source: https://www.credenceresearch.com/report/europe-insecticides-market