Global VSAT Market Trends and Forecast 2024–2032: Strategic Insights and Market Drivers

Market Overview

The Very Small Aperture Terminal (VSAT) Market was valued at USD 14.91 billion in 2024 and is projected to reach USD 27.39 billion by 2032, growing at a CAGR of 7.9% during the forecast period, as per Credence Research. The market expansion is driven by the rising demand for reliable global connectivity and high-throughput satellite solutions. Growth stems from maritime, aviation, defense, and rural broadband deployments that require secure, low-latency links. Advances in compact terminals, hybrid satellite–terrestrial networks, and IoT integration continue to enhance performance and broaden commercial and government use cases.

Source: https://www.credenceresearch.com/report/very-small-aperture-terminal-market

Market Drivers

Rising demand from remote industries

The Very Small Aperture Terminal (VSAT) Market grows because shipping, oil & gas, mining, and remote utilities need secure links where terrestrial networks fail. Enterprises adopt VSAT to maintain operations, protect data flow, and support telemetry and remote monitoring. Government initiatives for rural broadband and emergency communications further stimulate procurement and long-term service contracts.

Technology and infrastructure expansion

Satellite payload upgrades, high-throughput satellites, and compact terminals reduce cost per bit and expand capacity. Service providers offer scalable packages and private-network options that attract enterprise customers. Strong investment in network management platforms and IoT integration increases operational value and shortens deployment timelines for customers.

Market Trends and Opportunities

High-throughput and hybrid network adoption

Operators shift to HTS and hybrid satellite–terrestrial models to deliver higher bandwidth and resilience. It supports data-heavy applications like video and cloud services on vessels and aircraft. Providers that combine satellite capacity with dynamic routing gain competitive advantage and access new verticals.

Compact terminals and vertical expansion

Demand rises for portable, energy-efficient terminals that enable rapid deployment in disaster response, field operations, and media coverage. It opens opportunities in smart infrastructure, telemedicine, and remote education where guaranteed connectivity delivers clear social and commercial benefits.

Market Challenges

High upfront costs and complex deployment

The Very Small Aperture Terminal (VSAT) Market faces adoption limits from equipment and installation expenses, plus the need for trained staff. Remote sites increase logistics and maintenance burdens, which deter smaller buyers and slow rollouts in cost-sensitive regions. Providers must simplify deployment and offer managed services to broaden reach.

Weather, regulation, and spectrum constraints

Signal degradation in severe weather and varied regional spectrum rules create reliability and approvals hurdles. It forces extra engineering and compliance work, raising time to market. Companies that ensure robust modulation, redundancy, and clear regulatory strategies will reduce downtime and regulatory friction.

Key Players:

· Echostar Corporation (Hughes)

· Cobham Satcom

· Orbit Communication Systems Ltd

· Viasat Inc.

· Thuraya Telecommunications Company

· L3Harris Technologies, Inc.

· Singtel

· Gilat Satellite Networks Ltd.

· ODN, Inc.

· AsiaSatellite.co

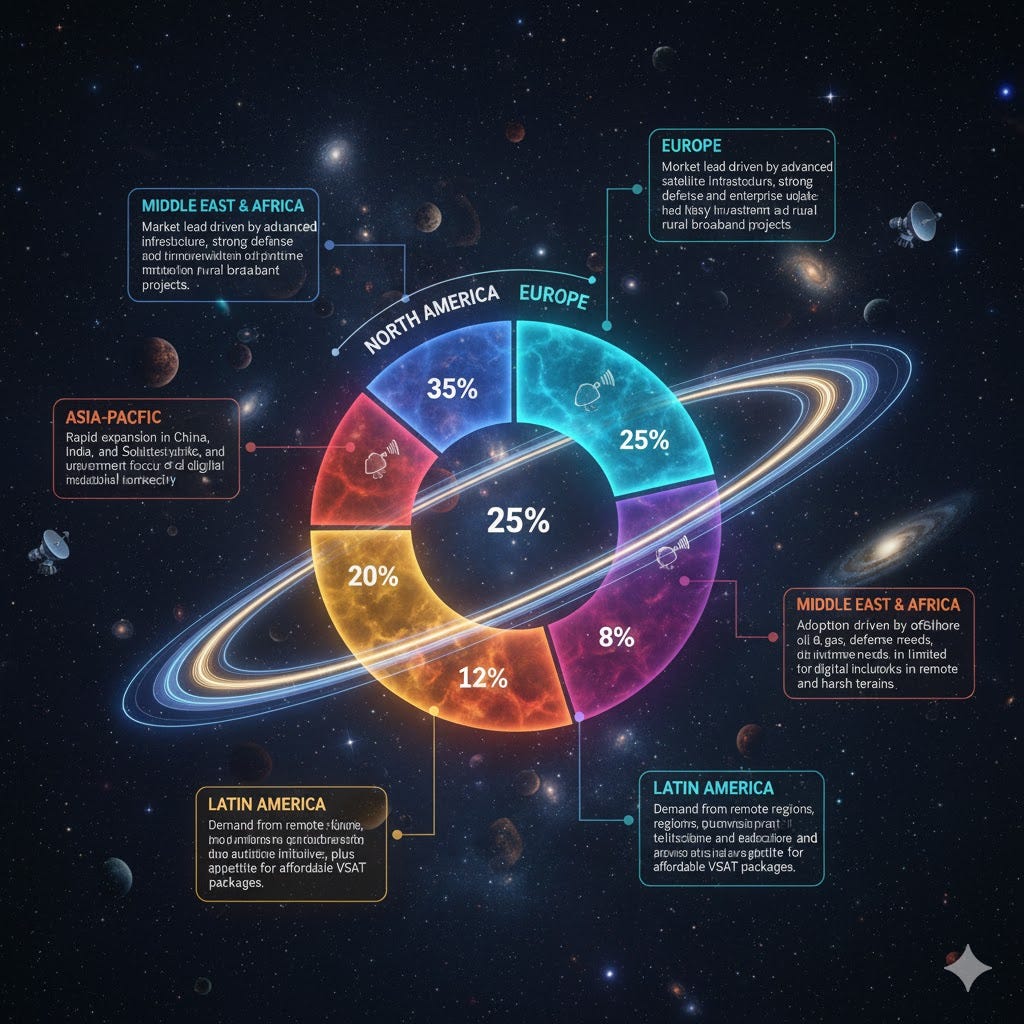

Regional Insights:

North America 35%: Market lead driven by advanced satellite infrastructure, strong defense and enterprise uptake, and heavy investment in maritime and rural broadband projects.

Europe 25%: Growth from maritime routes, offshore energy, and strict regulatory frameworks that support reliable VSAT services across commercial and government sectors.

Asia-Pacific 20%: Rapid expansion in China, India, and Southeast Asia due to urbanization, maritime traffic, and government focus on digital inclusion and industrial connectivity.

Latin America 12%: Demand from remote regions, maritime operations, and government telemedicine and education initiatives, plus appetite for affordable VSAT packages.

Middle East & Africa 8%: Adoption driven by offshore oil & gas, defense needs, and limited terrestrial networks in remote and harsh terrains.

Competitive Analysis

The Very Small Aperture Terminal (VSAT) Market shows intense competition among incumbents Orbit Communication Systems, L3Harris, Gilat, Viasat, Echostar, and Cobham who invest in HTS capacity, compact terminals, and managed services to win maritime, aviation, and defense contracts. Firms that pair scalable service models with regional partnerships and IoT integrations secure enterprise deals and faster deployments, while newer entrants focus on niche portable and low-latency solutions.

Go-To Market Strategy

Target critical verticals maritime, aviation, energy, defense, and rural broadband by offering modular managed services, flexible capacity plans, and rapid-deploy terminals. Build local reseller and systems-integration partnerships to navigate spectrum and regulatory needs. Offer trials and SLAs that demonstrate latency and throughput gains, bundle cloud and IoT integrations, and prioritize turnkey installs and 24/7 support to shorten procurement cycles and drive long-term contracts. Use case studies from early adopters to accelerate enterprise sales.

Recent Developments:

• L3Harris achieved Critical Design Review and Production Readiness Review for SDA Tranche 2 Tracking Layer (Aug 2025).

• Viasat launched a new high-throughput satellite service for maritime and aviation connectivity (2024).

• Cobham Satcom introduced SAILOR Fleet C and SAILOR 7200 GMDSS terminals (Sep 2024).

• Industry shift toward HTS and hybrid satellite–terrestrial offerings expanded capacity and lowered cost per Mbps.

• Increased integration of VSAT with IoT and cloud platforms to support remote monitoring and private networks.

Future Outlook

Demand for resilient, secure satellite connectivity will expand VSAT use across maritime, aviation, defense, and remote enterprise applications. Technology upgrades and partnerships will push terminals to become smaller, easier to deploy, and more tightly integrated with cloud and IoT platforms, enabling broader commercial adoption and deeper penetration into underserved regions.

Frequently Asked Questions

What was the VSAT market size in 2024?

The market value was USD 14.91 billion in 2024, per Credence Research.

What CAGR is the VSAT market forecast at?

The market is forecast to grow at a CAGR of 7.9% through 2032.

Which region led the VSAT market in 2024?

North America led with a 35% share driven by advanced infrastructure and enterprise adoption.

Who are the main VSAT providers?

Leading firms include Orbit Communication, L3Harris, Gilat, Viasat, Echostar, and Cobham Satcom.

For more: https://www.credenceresearch.com/report/very-small-aperture-terminal-market

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness