Market Overview: Growth Outlook and Emerging Patterns

Poland Insecticides Market grew from USD 297.50 million in 2018 to USD 382.80 million in 2024 and is projected to reach USD 526.21 million by 2032, expanding at a CAGR of 3.98% during the forecast period, as per Credence Research. The market expansion is driven by rising crop protection needs, adoption of modern farming techniques, and growing pest resistance to conventional chemicals. Shifts toward integrated pest management (IPM) and environmentally safer formulations are reshaping industry dynamics. It continues to gain momentum from export-focused agriculture, precision farming adoption, and favorable government support for sustainable crop protection, as per Credence Research.

For more: https://www.credenceresearch.com/report/poland-insecticides-market

Key Market Drivers Influencing Growth in Poland Insecticides Market

Rising Agricultural Intensification and Crop Protection Needs

Growing agricultural intensification boosts the demand for effective pest control solutions. Poland Insecticides Market benefits from the cultivation of high-value crops and increasing farm productivity goals. Farmers now adopt advanced insecticides to safeguard yields and comply with export quality norms. Government initiatives encourage investment in crop protection infrastructure and farmer education. Strong commodity prices fuel reinvestment in crop inputs. Expanding private distribution networks ensure better access and product availability in rural regions, strengthening market performance.

Technological Advancements and Regulatory Adaptations Shaping Market Demand

Precision application technology improves insecticide efficiency and reduces wastage. It motivates manufacturers to develop concentrated and user-friendly formulations. Partnerships between research institutions and international agrochemical companies enhance product innovation and regulatory compliance. Stringent residue norms create demand for selective chemistries with safer environmental profiles. Retail consolidation simplifies logistics and strengthens pricing leverage. Continuous farmer training initiatives promote correct product use, ensuring better adoption rates and sustainable pest management practices.

Market Trends and Opportunities Transforming the Poland Insecticides Market

Shift Toward Bio-Based and Selective Insecticide Solutions

The market is transitioning from broad-spectrum formulations to selective and bio-based products. Poland Insecticides Market witnesses strong demand for eco-friendly solutions that safeguard beneficial insects while ensuring effective pest control. International firms introduce new-generation actives paired with precision advisory platforms. Distributors launch private-label alternatives, increasing competition and price differentiation. Contract manufacturing expands to support small-scale biopesticide innovators. Rising export opportunities for low-residue formulations create new avenues for strategic investment.

Integration of Digital Agriculture and Pest Monitoring Services

Digital technologies are transforming pest management strategies across the country. It enables predictive pest forecasting and improves spray accuracy. Service bundles integrating insecticides with digital monitoring tools enhance overall farm efficiency. Large-scale farms embrace subscription-based crop protection services. Data-backed field trials strengthen product credibility and facilitate faster regulatory approvals. Collaborations between agri-tech startups and agrochemical companies open new growth opportunities and improve farmer engagement at the grassroots level.

Market Challenges Restricting Growth in the Poland Insecticides Market

Stringent Regulations and Rising Compliance Costs

Evolving EU and local regulations increase registration costs and delay product launches. Poland Insecticides Market faces challenges in replacing banned or phased-out active ingredients. Smaller companies struggle to manage data compliance expenses and slower approval processes. Retailers face difficulties managing inventory transitions amid regulatory changes. Farmers experience limited access to certain effective formulations. Import restrictions and logistical disruptions further intensify supply-chain uncertainties and price volatility.

Insect Resistance and Evolving Consumer Awareness

Resistance development among insect populations reduces the efficacy of long-used chemicals. It compels farmers to rotate active ingredients and adopt integrated pest management methods. Growing public awareness about pesticide safety influences product choice and farming practices. Environmental advocacy groups demand stronger safety assessments, prompting shifts to bio-rational alternatives. Companies invest more in resistance monitoring and farmer education programs to sustain control efficiency and build brand reliability in the market.

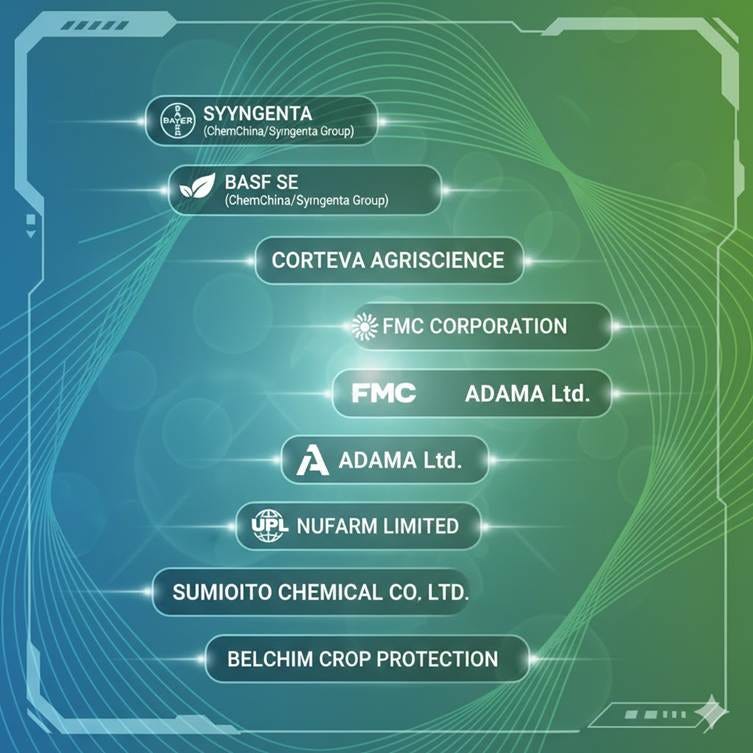

Key Players in the Poland Insecticides Market

-

Bayer AG

-

Syngenta (ChemChina/Syngenta Group)

-

BASF SE

-

Corteva Agriscience

-

FMC Corporation

-

ADAMA Ltd.

-

Nufarm Limited

-

UPL Limited

-

Sumitomo Chemical Co., Ltd.

-

Belchim Crop Protection

Regional Insights: Market Distribution Across Poland

North Poland (22%) – Major cereal and potato farming region with strong demand for contact and systemic insecticides.

South Poland (18%) – High-value fruit and vegetable production drives adoption of bio-insecticides and selective solutions.

Central Poland (24%) – Mixed farming and cooperative systems create stable demand for bulk formulations.

East Poland (20%) – Arable farming regions focus on cost-effective crop protection and local distributor partnerships.

West Poland (16%) – Export-oriented agriculture emphasizes low-residue and traceable insecticide formulations.

Competitive Analysis: Market Positioning and Strategic Landscape

Competition in the Poland Insecticides Market is defined by the presence of global leaders and regional specialists. Key players such as Bayer, Syngenta, BASF, Corteva, and FMC dominate through innovation, strong distribution, and regulatory competence. Regional suppliers compete through affordable pricing, customized formulations, and proximity to farmers. It rewards firms that offer integrated services combining product supply, training, and digital advisory tools. Partnerships, co-branding, and targeted marketing campaigns are strengthening market differentiation and consumer loyalty.

Go-To Market Strategy for Success in the Poland Insecticides Market

Successful entry requires combining regulatory approval with localized market engagement. Poland Insecticides Market thrives through partnerships with regional distributors and cooperatives to ensure wide product reach. Firms must emphasize local field trials, efficacy demonstrations, and transparent residue testing to gain farmer trust. Offering complete solutions such as pest forecasting, training, and stewardship support increases adoption. Focusing on specialty crops first before scaling to major cereals provides a balanced entry route. It demands consistent logistics, competitive pricing, and reliable after-sales support.

Recent Developments in the Poland Insecticides Market

-

Leading manufacturer expanded local distribution and introduced a farmer stewardship program.

-

New selective active ingredient approved for fruit and vegetable protection.

-

Cooperative programs promoting integrated pest management gained strong farmer participation.

-

Digital pest-monitoring tools launched across major agricultural regions.

-

Increased imports of bio-insecticides to meet demand for low-residue crop protection.

Future Outlook of the Poland Insecticides Market

Poland’s insecticides sector is expected to evolve toward precision-based and sustainable solutions. Farmers will prioritize integrated pest management and data-driven decisions. Bio-based formulations and low-residue products will gain preference among export-focused producers. Companies offering strong technical support, regulatory compliance, and efficient supply chains will lead market growth. Collaborative programs involving technology, training, and sustainability initiatives will define the next phase of agricultural protection in Poland.

Frequently Asked Questions (FAQs)

What is driving growth in the Poland Insecticides Market?

Growing crop intensification, pest resistance, and adoption of modern pest-control technologies drive consistent market growth.

Which insecticide types are gaining traction in Poland?

Bio-based and selective insecticides are gaining demand due to safety and environmental compliance standards.

How do regulations impact the market?

Strict EU and local pesticide regulations raise entry costs and limit product availability for smaller firms.

Who are the major players operating in this market?

Bayer, Syngenta, BASF, Corteva, and FMC dominate with innovation, broad distribution, and strong farmer networks.

For more: https://www.credenceresearch.com/report/poland-insecticides-market