The Future of Color: Unpacking the $5.34 Billion U.S. In-Organic Pigment Dispersion Market by 2032

The U.S. industrial landscape is undergoing a profound transformation, driven by an increasing emphasis on product aesthetics, durability, and environmental sustainability. At the core of this evolution lies the burgeoning U.S. In-Organic Pigment Dispersion Market, a critical component for industries ranging from construction to advanced packaging. An in-depth analysis of the market, as presented in a comprehensive report by Credence Research, reveals a robust growth trajectory, positioning this segment as a vital economic indicator of domestic manufacturing and innovation.

Source: https://www.credenceresearch.com/report/us-in-organic-pigment-dispersion-market

The Financial Trajectory: Strong Growth Through the Forecast Period

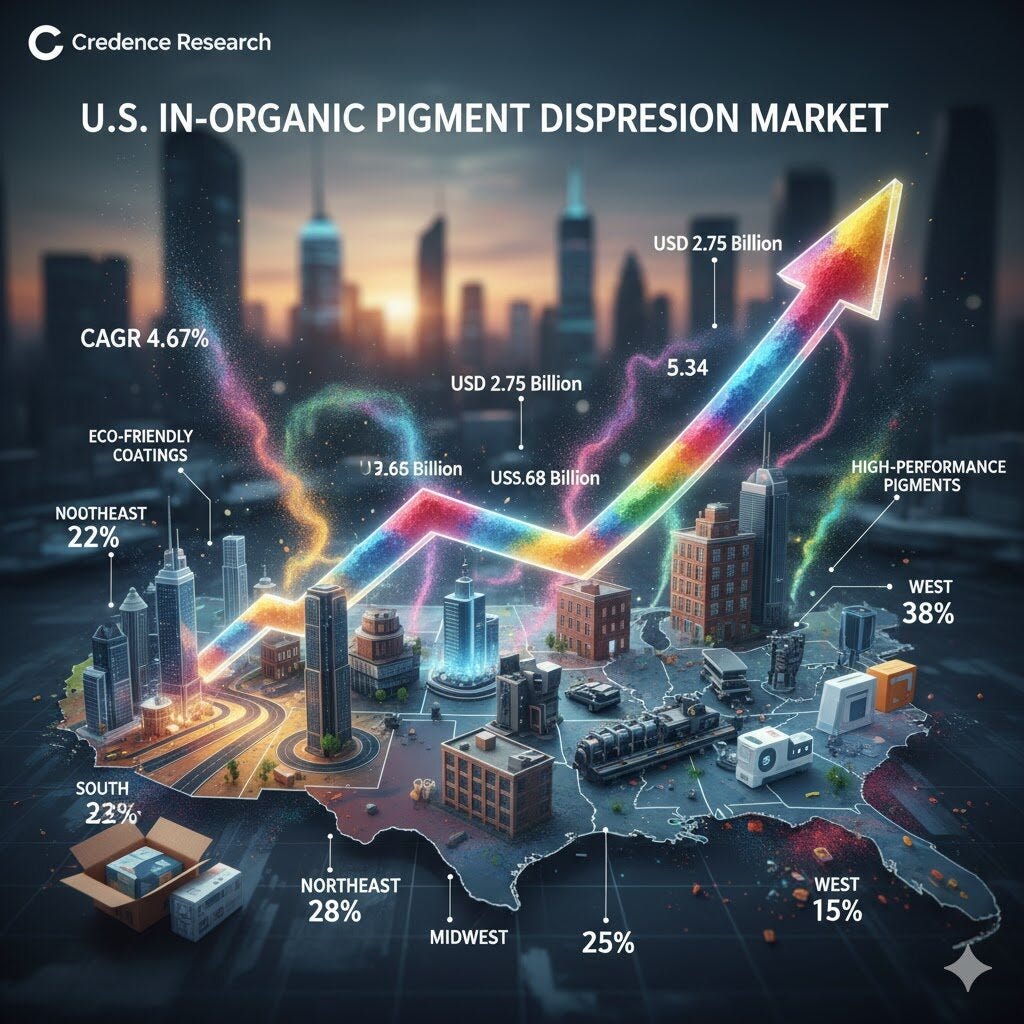

According to the insights published by Credence Research, the financial magnitude of the U.S. In-Organic Pigment Dispersion Market is set for a significant expansion. Valued at an impressive USD 2,752.77 million in 2018, the market demonstrated resilience and growth to reach USD 3,680.62 million in 2024. Looking ahead, the forecast period, spanning from 2025 to 2032, is projected to culminate in a market size of a staggering USD 5,341.39 million.

This projected expansion corresponds to a Compound Annual Growth Rate (CAGR) of 4.67% during the forecast period. This steady, reliable growth rate underscores the fundamental, non-discretionary role that pigment dispersions play in a myriad of industrial applications. The data from Credence Research, using 2024 as the Base Year and covering the Historical Period from 2020 to 2023, provides a solid foundation for understanding the market’s momentum. The leap from the U.S. In-Organic Pigment Dispersion Market Size 2024 of USD 3,680.62 million to the anticipated U.S. In-Organic Pigment Dispersion Market Size 2032 of over $5.34 billion is a clear signal of sustained industrial investment and technological advancement across the United States.

Fundamental Market Drivers: Enhancing Aesthetics and Performance

The primary impetus for this market expansion stems directly from increasing and diversified demand across four cornerstone sectors: construction, automotive, packaging, and consumer goods. In each of these industries, in-organic pigment dispersion systems are not merely colorants; they are performance enhancers.

The construction industry pigments segment is a heavy consumer, utilizing these dispersions to improve the durability and longevity of materials used in exterior and interior applications. Pigments are essential for protective coatings that guard against weathering, UV degradation, and chemical exposure, all while enhancing the aesthetic appeal of buildings and infrastructure projects. As urbanization continues, especially in dense metropolitan areas, the demand for durable and vibrant architectural coatings drives the market forward.

The automotive coatings sector represents another major growth engine. The pursuit of enhanced paint quality, superior gloss retention, and resistance to environmental damage is paramount for vehicle manufacturers. High-performance pigments are integrated into topcoats and basecoats to ensure optimal color matching, consistency, and resistance to chipping and fading. Furthermore, the push towards lighter-weight vehicles and advanced material composites necessitates specialized in-organic pigment dispersion formulations that can adhere effectively and maintain their integrity under stress.

The packaging industry, encompassing everything from flexible films to rigid containers, also relies heavily on these materials. Pigments provide the necessary branding and visual appeal, but equally important, they offer barrier properties and light-blocking capabilities that protect perishable goods. The innovation in the packaging industry is rapid, demanding flexible pigment systems that can be applied effectively across various substrates, further fueling the market for advanced dispersions.

Sustainability, Regulation, and Technological Innovation

A significant factor shaping the future of the U.S. In-Organic Pigment Dispersion Market is the regulatory environment and the parallel shift toward sustainability. Regulations promoting eco-friendly coatings and sustainable materials are compelling manufacturers to adopt newer, cleaner technologies. This drive for lower environmental impact is pushing demand for advanced inorganic dispersions that offer higher efficiency, meaning less product is needed for the same level of performance, thereby reducing waste and energy consumption in application.

The core of market evolution lies in dispersion technologies and formulations. Ongoing research ensures that end-users gain benefits that directly address their performance requirements. Key improvements include:

-

Improved Opacity: Allowing thinner film applications while achieving complete coverage.

-

Color Stability: Ensuring colors remain true over extended periods, resisting fading caused by UV light and harsh chemicals.

-

Resistance to Harsh Conditions: Vital for industrial applications, where coatings must withstand extreme temperatures, abrasion, and corrosive environments.

Manufacturers are constantly innovating to produce highly concentrated, yet easily incorporated, pigment dispersions that offer superior wetting and stabilizing properties. These advancements are crucial for maintaining consistency and optimizing the application process across diverse substrates and machinery, contributing directly to the market’s steady expansion and the reliability of high-performance pigments.

Regional Dynamics: The Balanced Leadership of U.S. Subregions

The U.S. In-Organic Pigment Dispersion Market is not monolithic; its leadership is strongly regionalized, reflecting the concentration of specific industrial and economic activities across the nation. The market’s regional breakdown provides a clear picture of localized drivers:

-

The South: Holding the largest share at a significant 32%, the South stands as the dominant market force. This leadership is underpinned by rapid urbanization, massive infrastructure growth projects, and substantial demand from the growing manufacturing and packaging industry base in the region. The expanding population and consequent residential and commercial construction boom cement the region’s position as the primary consumption hub for protective and decorative coatings.

-

The Northeast: Following with a considerable 28% market share, the Northeast is driven primarily by its dense concentration of construction projects, especially in renewal and redevelopment, and its robust printing activities. The region’s history as a manufacturing and printing center continues to sustain high demand for specialized pigment systems used in high-quality publications, labels, and industrial coatings.

-

The Midwest: Accounting for 25% of the market, the Midwest’s activity is strongly anchored by its formidable automotive and industrial base. As the heart of U.S. vehicle manufacturing, the demand for automotive coatings and high-performance pigments for machinery and heavy equipment is consistently high. This Midwest automotive base requires a steady supply of advanced dispersions that meet stringent durability and aesthetic standards.

-

The West: Contributing the remaining 15%, the West is characterized by innovation and demand from advanced packaging industries and high-tech manufacturing. While its share is smaller, the West often acts as a proving ground for new, specialized, and high-value dispersion technologies, especially those geared towards niche markets and high-end consumer goods. The region’s focus on environmentally conscious practices also accelerates the adoption of the latest eco-friendly coatings formulations.

Together, these subregions reflect a pattern of balanced growth, sustained by broad-based industrial expansion, concerted sustainability efforts, and strategic capital investments across diverse industrial applications.

A Foundation for Future Industrial Growth

The data from Credence Research paints a compelling picture of a market that is fundamentally intertwined with the nation’s industrial health and its commitment to quality and sustainability. The projected growth to USD 5,341.39 million by 2032 is not merely a statistical figure; it represents the ongoing need for materials that deliver superior performance, durability, and aesthetic value.

From the regulatory pressures that favor sustainable materials to the technological breakthroughs that enhance color stability and opacity, the U.S. In-Organic Pigment Dispersion Market is clearly on a path of continuous refinement and expansion. For manufacturers, investors, and policymakers, understanding the 4.67% CAGR and the key drivers from the South market share 32% leadership to the specialized needs of the Midwest automotive base is essential for navigating the opportunities within this vital $5 billion market. The pursuit of enhanced product performance, driven by innovation in dispersion technologies and supported by industrial demand, ensures that this market will remain one of the most dynamic and critical segments in the U.S. chemical and materials sector for the foreseeable future.

Source: https://www.credenceresearch.com/report/us-in-organic-pigment-dispersion-market

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness