Asia Pacific Oral Care Market Price, Trends, Growth, Analysis, Size, Share, Report, Forecast 2025-2032

Asia-Pacific Oral Care Market — A Transformative Growth Story

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/asia-pacific-oral-care-market/2289

1. Market Estimation & Definition

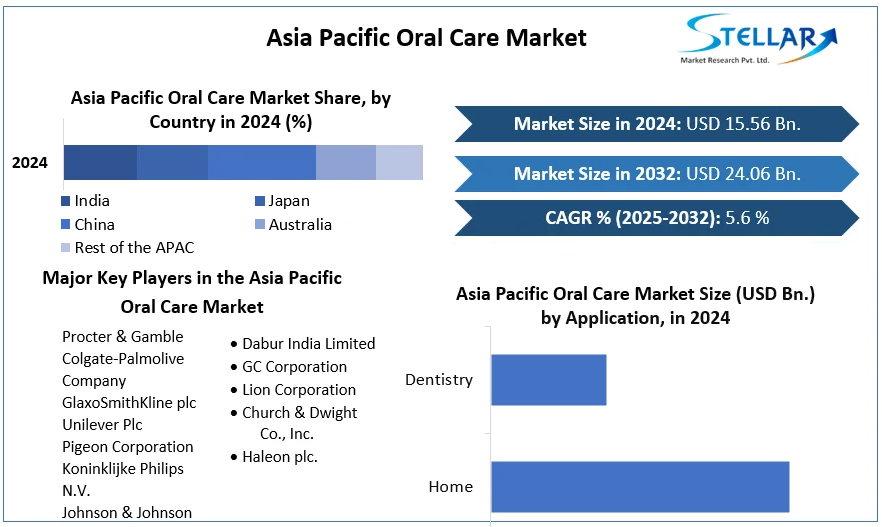

The Asia-Pacific oral care market was valued at approximately USD 15.56 billion in 2024, and is projected to grow to USD 24.06 billion by 2032, representing a compound annual growth rate (CAGR) of about 5.6% during the period 2025-2032.

In this context, “oral care” refers to consumer self-care products used for daily dental hygiene and mouth health routines — including toothpaste, toothbrushes (manual), mouthwashes/rinses, and dental accessories. The category notably excludes professional dental services and major device segments (such as full electric toothbrush systems) in this report’s scope.

Asia-Pacific (APAC) is a region spanning a broad set of countries — China, India, Japan, South Korea, Australia, ASEAN nations and others — with wide variation in consumer behaviour, oral-health awareness, income levels and distribution infrastructure. The market is being shaped by the interplay of increasing oral-health concerns, rising consumer spending on personal care, expansion of retail & e-commerce channels, and product innovation.

2. Market Growth Drivers & Opportunity

Several key growth drivers and opportunities underpin the expansion of the Asia-Pacific oral care market:

a) Rising Prevalence of Oral Health Issues

A critical driver is the high and growing incidence of dental ailments in the region. For example, childhood caries in many Asia-Pacific markets ranges from 60-90% in certain age groups.

Dental issues such as tooth decay, gingivitis, sensitivity, enamel erosion and missing teeth are increasingly common due to diet (high sugar intake), urban lifestyles, limited preventive dental visits in some markets, and ageing populations. This underlying health burden creates the foundational demand for oral care products.

b) Growing Consumer Awareness & Preventive Mindset

As middle-class incomes rise, and as dental awareness improves (through government programmes, private campaigns and social media), consumers are investing more in preventive oral care. Rather than waiting for a dental problem, they increasingly purchase daily use oral-care products (toothpaste, mouthwash) and premium variants (sensitivity, whitening, herbal). The report notes that rising awareness and preventive spending significantly contribute to market growth.

c) Rising Disposable Incomes & Premiumisation

Millions of households in nations such as China and India now have higher discretionary spending. With that, there is willingness to upgrade from basic (economy) oral-care products to mid and premium-priced items — whether for better brandin

d) Retail & E-commerce Channel Growth

The growth of modern retail (supermarkets/hypermarkets), pharmacies, convenience stores and especially online distribution is providing improved access. In many APAC countries, e-commerce penetration is rising rapidly, offering convenience and enabling smaller brands to reach consumers directly. The report highlights that while traditional retail still dominates, online is the fastest growing channel.

e) Innovation & Localisation

Manufacturers are increasingly tailoring oral-care products to regional needs (herbal preferences, local taste, children’s variants, multifunctional formats). Also, newer formats such as mouthwashes, dental accessories and advanced toothpastes are growing faster. The report points to “toothpaste remains dominant” while “mouthwash expected to grow fastest” owing to newer adoption.

f) Opportunity in Under-penetrated Segments & Regions

Despite the scale, many parts of Asia-Pacific remain under-penetrated in terms of oral-care spend per capita compared to Western markets. There is opportunity in Tier 2/3 cities, rural markets, children’s and ageing populations’ special segments, subscription-models and value-added formats.

3. What Lies Ahead: Emerging Trends Shaping the Future

Looking forward, several emerging trends will likely shape how the Asia-Pacific oral care market evolves:

Smart & tech-enabled oral care devices and consumables

Though the current report excludes full electric brush systems, the spill-over effect of smart toothbrushes (Bluetooth-enabled, app-linked) and connected oral-care ecosystems will influence consumer expectations across the region. As device adoption rises, consumables and complementary products (e.g., premium toothpaste, replacement heads) will benefit indirectly.

Natural, herbal & clean-label positioning

Consumers in APAC increasingly value herbal, plant-based, minimal-chemical and eco-friendly oral care options. This trend aligns with wellness and clean-beauty movements. Brands that emphasise natural ingredients, sustainable packaging and localised formulations will captivate sections of the market.

Customisation & niche segment growth

Segments such as children’s oral care, denture & ageing adult care, sensitivity/enamel repair formats, children’s “fun” toothpaste, and mouthwash for specific indications are growing. The pace of change is high in markets where basic penetration is still climbing.

Digital commerce & D2C models

With increased smartphone penetration, social-commerce, influencer marketing and D2C subscription models (toothpaste refills, brush-head replacements) are gaining traction. Brands can bypass traditional retail bottlenecks and engage directly with consumers for loyalty, data and recurring revenue.

Regional expansion & rural penetration

As urban growth stabilises, growth will increasingly come from semi-urban and rural zones. Companies with distribution reach and affordability strategies will gain share. Also countries such as Vietnam, Indonesia, Philippines and others within ASEAN represent significant growth levers.

Premiumisation within mass market

Even in price-sensitive markets, there is movement toward “masstige” — mass market products with premium positioning (better packaging, added fluoride, herbal extracts, whitening variants) at accessible price points. The convergence of quality and affordability will define winners.

Regulatory & health-policy support

Governments in APAC markets are placing more focus on oral health as part of overall public health agendas. Subsidies, campaigns, school programmes, fluoridation drives and dental-check-up promotion raise awareness and product consumption indirectly.

Sustainability & circular economy

Packaging innovation, recyclable or biodegradable tubes, refill formats, and awareness about waste will increasingly matter in Asia-Pacific. While still nascent, brands that invest early may secure competitive advantage.

4. Segmentation Analysis

From the referenced report, the Asia-Pacific oral care market is segmented as follows:

By Product Type:

-

Toothpaste

-

Toothbrushes

-

Mouthwashes/Rinses

-

Denture Products

-

Others / Dental Accessories

By Application/End-Use:

-

Home (consumer self-care)

-

Dentistry / Professional use

By Distribution Channel:

-

Supermarkets & Hypermarkets

-

Retail Pharmacies / Drug Stores

-

Online Distribution

By Country/Region (within APAC):

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

ASEAN (including Indonesia, Vietnam, Thailand, Malaysia, Philippines, etc.)

-

Rest of Asia-Pacific

Key observations from the segmentation:

-

The toothpaste segment is currently the largest share, reflecting its foundational daily-use nature.

-

The mouthwash/rinses segment is showing faster growth, driven by rising awareness of convenience, breath-freshening and multi-benefit formats.

-

The online channel is the fastest-growing distribution path due to convenience and product variety—even though supermarkets/hypermarkets remain dominant in absolute size.

-

Countries such as China and India dominate value and volume simply by population size and growing dental-care spend, while smaller ASEAN markets represent rapid growth potential.

5. Country-Level Analysis

Let’s focus on two of the major markets: China and India.

China

China is the largest single-country market within Asia-Pacific for oral care. The report states strong growth due to large population, rising household income, improved dental health awareness, and premiumisation of oral-care consumption.

Within China, consumer trends are moving toward premium toothpaste (whitening, herbal), advanced toothbrushes, mouthwash and multi-benefit formats. Also, digital/social media penetration (WeChat, Xiaohongshu, Douyin) aids marketing and brand building. The growth of e-commerce (T Mall, JD) is significant in reaching consumers in Tier 2/3 cities.

Challenges include high competition, local players, price sensitivity in some segments, and rural penetration still needing attention.

India

India represents a high-growth opportunity due to rising dental issues (over 90% of adults experience dental disease in some studies), increasing awareness, rising disposable incomes, and expanding retail/e-commerce networks.

In India, while basic oral-care penetration is high (daily use toothpaste), there is significant room for growth in premium formats (whitening, herbal, children’s kits), toothbrushes beyond basic manual, mouthwashes and accessories. The school-health programmes and public dental awareness campaigns also support growth.

Distribution challenges include rural reach, affordability constraints and fragmented retail networks—but these also represent future growth corridors.

Other markets such as Japan and South Korea are mature but offer premiumisation, niche segments, device adoption (electric toothbrushes) and high value per consumer. ASEAN countries (Vietnam, Thailand, Indonesia, Malaysia, Philippines) are emerging rapidly with increasing spend and modern retail penetration.

6. Commutator (SWOT-Style) Analysis

Here is a SWOT (Strengths, Weaknesses, Opportunities, Threats) – or “commutator” – analysis for the Asia-Pacific oral care market:

Strengths

-

Large and growing population base in many APAC countries; growing middle-class and rising disposable incomes.

-

Strong underlying demand driven by high incidence of dental issues and rising health awareness.

-

Opportunity for premiumisation, innovation, and brand differentiation in a region moving beyond basic oral care.

-

Rapid growth in online distribution and modern retail infrastructure enabling broader reach and convenience.

Weaknesses

-

Price sensitivity in many markets—premium products may face resistance in lower-income segments.

-

High competition and presence of many established players and local brands; margin pressure.

-

Heterogeneous market – significant variation in consumer behaviour, regulation, dental awareness and distribution across countries.

-

Basic daily-use segments (toothpaste, manual toothbrush) may be near saturation in urban centres, limiting pure volume growth; thus value growth becomes more critical.

Opportunities

-

Growth of premium and value-added formats: specialty toothpaste (whitening, sensitivity, herbal), mouthwashes, denture/ageing adult products, children’s kits.

-

Expansion into under-penetrated regions: rural areas, smaller cities, ASEAN and South-Asian markets.

-

Rise of subscription models, D2C e-commerce, digital marketing and engagement, which can deepen consumer loyalty and increase repeat purchase value.

-

Sustainability and natural/eco-formats – there is consumer interest and limited current supply in some markets, representing a differentiator.

-

Adjacent segments: smart toothbrush consumables, connected dental hygiene apps/devices supporting the product ecosystem.

Threats

-

Economic slowdowns, inflation, or rising cost of living may cause consumers to down-trade from premium to economy products or delay upgrades.

-

Regulatory frameworks may change (ingredient restrictions, packaging rules, tax/impacts) adding compliance cost.

-

Raw-material cost increases (for ingredients, packaging) and supply-chain disruptions may impact margin and availability.

-

Rising competition from generic, local or private-label brands could erode market share and pricing power for leading brands.

-

Consumer preference shifts or negative publicity about certain ingredients may impact formulations/trust.

7. Press Release Style Conclusion

The Asia-Pacific oral care market is set for a compelling growth trajectory — growing from approximately USD 15.56 billion in 2024 to USD 24.06 billion by 2032 at a CAGR of about 5.6%. This growth is underpinned by rising oral-health awareness, large populations, rising disposable incomes, increasing premiumisation and strengthening retail & online channels.

China and India are clear growth engines, with vast population bases and rising personal-care expenditure, while other APAC markets—including Japan, South Korea, Australia and ASEAN nations—offer premium-segment potential, evolving consumer habits and digital retail expansion.

For manufacturers, retailers and oral-care brands, the message is clear: success will be driven not simply by volume but by value — that means innovation in product formulations (whitening, sensitivity, herbal, children’s), premiumisation, channel diversification (especially online), localisation of consumer offerings and strong branding.

Companies that align with consumer trends — preventive oral health, digital engagement, sustainability and convenience — and build distribution capabilities across urban, semi-urban and rural corridors, are best positioned to capture this opportunity.

In a region as diverse as Asia-Pacific, agility, insight into local market dynamics and nimble go-to-market strategies will differentiate winners. The growth story is not just about bigger size — it is about smarter, higher-value offerings that meet evolving oral-care needs of millions of consumers.

In summary: The Asia-Pacific oral care market is entering a new chapter — one where oral hygiene transforms into oral wellness, where toothpaste and toothbrush are just the beginning, and where subscription models, digital brushes, premium formats and wellness narratives become central. For incumbents and new entrants alike, the region offers both scale and transformation opportunity — making it a core battleground for the future of oral-care excellence.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

sales@stellarmr.com

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness