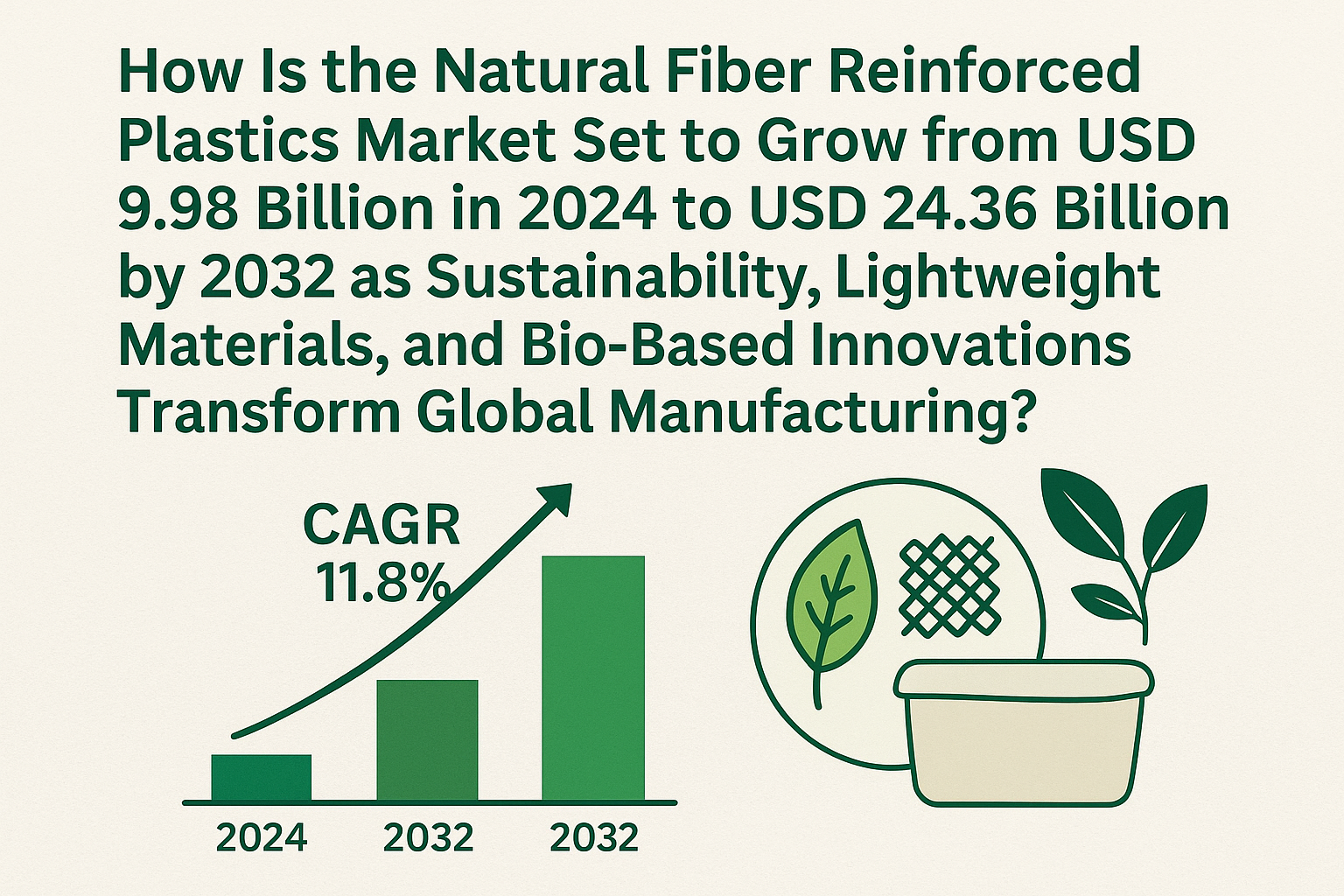

How Is the Natural Fiber Reinforced Plastics Market Set to Grow from USD 9.98 Billion in 2024 to USD 24.36 Billion by 2032 as Sustainability, Lightweight Materials, and Bio-Based Innovations Transform Global Manufacturing?

Introduction

The global industrial landscape is undergoing a profound transformation driven by sustainability, performance optimization, and regulatory pressures. Among the materials benefiting most from this shift are Natural Fiber Reinforced Plastics (NFRPs)—a class of composite materials that combine polymer matrices with fibers derived from renewable biological sources such as flax, hemp, jute, sisal, coir, kenaf, bamboo, and other plant-based reinforcements.

According to market estimates, the Natural Fiber Reinforced Plastics Market was valued at USD 9.98 Billion in 2024 and is expected to reach USD 24.36 Billion by 2032, reflecting an impressive CAGR of 11.8% during the forecast period. This sharp upward trajectory highlights the increasing commercial acceptance and technological maturation of natural fiber composites across industries such as automotive, aerospace, packaging, construction, consumer goods, and electronics.

But what exactly is fueling this rapid expansion? Why are manufacturers shifting from conventional synthetic fiber composites like carbon fiber and glass fiber to natural fiber alternatives? And how are government policies, environmental regulations, consumer preferences, and technological innovations converging to reshape this market?

This in-depth article explores these questions, examining growth drivers, challenges, competitive dynamics, emerging opportunities, and sector-wise adoption trends. It provides a comprehensive overview of how NFRPs are positioning themselves as a cornerstone of the circular economy and the future of sustainable manufacturing.

1. Understanding Natural Fiber Reinforced Plastics: A Sustainable Composite Revolution

Natural Fiber Reinforced Plastics consist of:

- A polymer matrix (thermoplastics like PP, PE, PLA, or thermosets like epoxy)

- Natural reinforcement fibers such as:

- Jute

- Flax

- Hemp

- Kenaf

- Sisal

- Ramie

- Coir

- Bamboo fibers

These fibers are biodegradable, renewable, lightweight, and often exhibit impressive mechanical and thermal properties relative to their weight. Compared to synthetic fibers, natural fibers offer:

- Lower density

- Reduced carbon footprint

- Cost advantages

- Reduced environmental toxicity

- Energy-efficient processing

This makes NFRPs particularly appealing at a time when industries are aggressively transitioning toward eco-friendly materials and carbon-neutral manufacturing practices.

2. Market Growth Outlook: Why the NFRP Market Is Expanding at 11.8% CAGR

With the market set to escalate from USD 9.98 billion (2024) to USD 24.36 billion (2032), several macro and micro-level factors are driving adoption.

2.1 Sustainability-Driven Demand

NFRPs align with global environmental goals aimed at:

- Reducing dependency on non-renewable raw materials

- Minimizing waste

- Creating recyclable and biodegradable composite solutions

This sustainability-centered advantage is helping NFRPs replace glass-fiber composites in applications that previously seemed non-negotiable.

2.2 Regulatory Support and Ban on Single-Use Plastics

Governments worldwide are promoting:

- Bio-based materials

- Low-emission manufacturing

- Sustainable automotive components

- Recyclable packaging

These regulations directly accelerate the adoption of natural fiber composites.

2.3 Lightweight Material Trend in Automotive and Transportation

The automotive industry is among the largest adopters of NFRPs due to:

- Weight reduction benefits (20–30% lighter than glass-fiber composites)

- Lower energy consumption during production

- Reduced CO₂ emissions per vehicle

- Improved crash safety due to excellent energy absorption properties

Leading OEMs now integrate NFRP materials into door panels, dashboards, seat backs, interior trims, and structural elements.

2.4 Cost Advantages Over Synthetic Fibers

Natural fibers require:

- Lower production energy

- Cheaper raw material inputs

- Simple processing techniques

These savings amplify their commercial attractiveness, especially for high-volume industries.

2.5 Advancements in Composite Manufacturing Technologies

Innovations such as:

- Bio-resins

- Advanced fiber treatments

- Hybrid composites

- Injection molding and compression technologies

… have dramatically improved the mechanical properties, moisture resistance, and durability of NFRPs.

3. Key Market Drivers Shaping the Future

3.1 Zero-Emission Goals and the Push for Circular Manufacturing

Countries, especially in Europe and North America, are adopting circular economy roadmaps that mandate:

- A reduction in synthetic material use

- Extended producer responsibility (EPR)

- High recyclability

- Reduced waste generation

NFRPs fit perfectly into this framework.

3.2 Growth of Bio-Based Industries

Increasing investment in bio-based chemicals and polymers supports the use of eco-friendly reinforcements, thereby strengthening NFRP ecosystems.

3.3 Green Building Initiatives

In construction, NFRPs enable:

- Eco-friendly insulation

- Lightweight panels

- Structural reinforcements

- Acoustic materials

This supports green building certifications such as LEED and BREEAM.

3.4 Rise of Natural Fiber-Based Packaging

Plastic packaging waste is a global crisis. NFRP-based packaging provides:

- Reduced carbon emissions

- Biodegradability

- High strength-to-weight ratio

The rising e-commerce and FMCG sectors are boosting demand.

3.5 Consumer Preference for Eco-Friendly Products

In consumer electronics and household appliances, NFRPs are increasingly replacing traditional plastic components to meet customer sustainability expectations.

4. Market Challenges: Barriers Slowing Down Adoption

Although the outlook is strong, certain obstacles must still be addressed.

4.1 Moisture Sensitivity

Natural fibers tend to absorb moisture, leading to:

- Dimensional instability

- Reduced mechanical strength

Surface treatment and resin compatibility improvements are required.

4.2 Variable Fiber Quality

Natural fibers vary based on:

- Climate

- Soil conditions

- Harvesting techniques

This variability impacts consistency in final composite performance.

4.3 Competition from Synthetic Composites

Glass-fiber composites remain:

- Stronger

- More durable

- More mature in industrial applications

Bridging the performance gap remains a challenge.

4.4 Low Awareness in Emerging Markets

Lack of technical expertise and limited production facilities restrict NFRP adoption in developing regions.

5. Market Segmentation Overview

By Fiber Type

- Flax – high strength-to-weight ratio

- Hemp – excellent performance in automotive applications

- Jute – cost-effective, widely available in Asia

- Kenaf – strong thermal and acoustic properties

- Sisal – durable and highly tensile

By Polymer Type

- Thermoplastics (PP, PE, PLA) – dominant due to ease of processing

- Thermosets (epoxy, polyester) – used in high-strength applications

By End-Use Industry

- Automotive – largest segment

- Construction – rising adoption

- Packaging – rapid growth

- Consumer goods – sustainable electronics

- Aerospace – lightweight composites for interiors

6. Regional Market Analysis

6.1 Europe – Leading the Global Market

Driven by:

- Strict environmental regulations

- Strong automotive industry

- Investments in bio-based materials

- High demand for recyclable products

Germany, France, and the UK are key centers of innovation.

6.2 North America – Sustainability and Automotive Innovation

The U.S. and Canada are witnessing growth due to:

- Electric vehicle (EV) adoption

- Higher emphasis on sustainable manufacturing

- Government incentives for bio-material technologies

6.3 Asia-Pacific – Fastest-Growing Region

Factors include:

- Large-scale availability of natural fibers (India, Bangladesh, China)

- Growing construction and automotive industries

- Increased investment in biodegradable materials

6.4 Latin America and Middle East – Emerging Opportunities

Brazil’s strong agro-sector promotes fiber availability, while the Middle East focuses on sustainable construction.

7. Competitive Landscape

Key companies include:

- Advanced composites manufacturers

- Bio-material companies

- Polymer developers

- Automotive OEMs integrating NFRPs

Strategic initiatives involve:

- Partnerships with agriculture cooperatives

- Investments in fiber treatment facilities

- New resin development

- Eco-friendly product design

8. Future Outlook: What Will Shape the Market by 2032?

Looking ahead, several trends will redefine industry dynamics:

8.1 Integration with Electric Vehicles

EV manufacturers prefer lightweight materials for:

- Enhanced battery efficiency

- Extended driving range

This will significantly boost NFRP adoption.

8.2 Bio-Resin Innovations

Next-gen bio-resins will enhance:

- Strength

- Moisture resistance

- Durability

Making NFRPs more competitive with synthetic composites.

8.3 Increased Automation in Composite Manufacturing

Automated production lines will reduce costs and improve quality uniformity.

8.4 Circular Economy Integration

Recycling and composting technologies will enhance lifecycle sustainability.

8.5 Growing Role in Consumer Electronics

Tech companies are experimenting with NFRP-based:

- Laptop casings

- Smartphone covers

- Speakers

- Wearable devices

This emerging segment will contribute significantly to market expansion.

Conclusion

The Natural Fiber Reinforced Plastics Market is evolving rapidly, driven by global sustainability goals, industrial innovation, and regulatory support. As industries transition away from petroleum-based and synthetic materials, NFRPs offer a compelling alternative—combining eco-friendliness, performance, light weight, and cost efficiency.

With the market expected to grow from USD 9.98 Billion in 2024 to USD 24.36 Billion by 2032, the next decade will witness an accelerated shift toward natural fiber composites across automotive, construction, packaging, consumer goods, and aerospace sectors.

NFRPs are no longer niche materials—they are becoming essential building blocks of the future bio-based, circular global economy.

Introduction

The global industrial landscape is undergoing a profound transformation driven by sustainability, performance optimization, and regulatory pressures. Among the materials benefiting most from this shift are Natural Fiber Reinforced Plastics (NFRPs)—a class of composite materials that combine polymer matrices with fibers derived from renewable biological sources such as flax, hemp, jute, sisal, coir, kenaf, bamboo, and other plant-based reinforcements.

According to market estimates, the Natural Fiber Reinforced Plastics Market was valued at USD 9.98 Billion in 2024 and is expected to reach USD 24.36 Billion by 2032, reflecting an impressive CAGR of 11.8% during the forecast period. This sharp upward trajectory highlights the increasing commercial acceptance and technological maturation of natural fiber composites across industries such as automotive, aerospace, packaging, construction, consumer goods, and electronics.

But what exactly is fueling this rapid expansion? Why are manufacturers shifting from conventional synthetic fiber composites like carbon fiber and glass fiber to natural fiber alternatives? And how are government policies, environmental regulations, consumer preferences, and technological innovations converging to reshape this market?

This in-depth article explores these questions, examining growth drivers, challenges, competitive dynamics, emerging opportunities, and sector-wise adoption trends. It provides a comprehensive overview of how NFRPs are positioning themselves as a cornerstone of the circular economy and the future of sustainable manufacturing.

1. Understanding Natural Fiber Reinforced Plastics: A Sustainable Composite Revolution

Natural Fiber Reinforced Plastics consist of:

- A polymer matrix (thermoplastics like PP, PE, PLA, or thermosets like epoxy)

- Natural reinforcement fibers such as:

- Jute

- Flax

- Hemp

- Kenaf

- Sisal

- Ramie

- Coir

- Bamboo fibers

These fibers are biodegradable, renewable, lightweight, and often exhibit impressive mechanical and thermal properties relative to their weight. Compared to synthetic fibers, natural fibers offer:

- Lower density

- Reduced carbon footprint

- Cost advantages

- Reduced environmental toxicity

- Energy-efficient processing

This makes NFRPs particularly appealing at a time when industries are aggressively transitioning toward eco-friendly materials and carbon-neutral manufacturing practices.

2. Market Growth Outlook: Why the NFRP Market Is Expanding at 11.8% CAGR

With the market set to escalate from USD 9.98 billion (2024) to USD 24.36 billion (2032), several macro and micro-level factors are driving adoption.

2.1 Sustainability-Driven Demand

NFRPs align with global environmental goals aimed at:

- Reducing dependency on non-renewable raw materials

- Minimizing waste

- Creating recyclable and biodegradable composite solutions

This sustainability-centered advantage is helping NFRPs replace glass-fiber composites in applications that previously seemed non-negotiable.

2.2 Regulatory Support and Ban on Single-Use Plastics

Governments worldwide are promoting:

- Bio-based materials

- Low-emission manufacturing

- Sustainable automotive components

- Recyclable packaging

These regulations directly accelerate the adoption of natural fiber composites.

2.3 Lightweight Material Trend in Automotive and Transportation

The automotive industry is among the largest adopters of NFRPs due to:

- Weight reduction benefits (20–30% lighter than glass-fiber composites)

- Lower energy consumption during production

- Reduced CO₂ emissions per vehicle

- Improved crash safety due to excellent energy absorption properties

Leading OEMs now integrate NFRP materials into door panels, dashboards, seat backs, interior trims, and structural elements.

2.4 Cost Advantages Over Synthetic Fibers

Natural fibers require:

- Lower production energy

- Cheaper raw material inputs

- Simple processing techniques

These savings amplify their commercial attractiveness, especially for high-volume industries.

2.5 Advancements in Composite Manufacturing Technologies

Innovations such as:

- Bio-resins

- Advanced fiber treatments

- Hybrid composites

- Injection molding and compression technologies

… have dramatically improved the mechanical properties, moisture resistance, and durability of NFRPs.

3. Key Market Drivers Shaping the Future

3.1 Zero-Emission Goals and the Push for Circular Manufacturing

Countries, especially in Europe and North America, are adopting circular economy roadmaps that mandate:

- A reduction in synthetic material use

- Extended producer responsibility (EPR)

- High recyclability

- Reduced waste generation

NFRPs fit perfectly into this framework.

3.2 Growth of Bio-Based Industries

Increasing investment in bio-based chemicals and polymers supports the use of eco-friendly reinforcements, thereby strengthening NFRP ecosystems.

3.3 Green Building Initiatives

In construction, NFRPs enable:

- Eco-friendly insulation

- Lightweight panels

- Structural reinforcements

- Acoustic materials

This supports green building certifications such as LEED and BREEAM.

3.4 Rise of Natural Fiber-Based Packaging

Plastic packaging waste is a global crisis. NFRP-based packaging provides:

- Reduced carbon emissions

- Biodegradability

- High strength-to-weight ratio

The rising e-commerce and FMCG sectors are boosting demand.

3.5 Consumer Preference for Eco-Friendly Products

In consumer electronics and household appliances, NFRPs are increasingly replacing traditional plastic components to meet customer sustainability expectations.

4. Market Challenges: Barriers Slowing Down Adoption

Although the outlook is strong, certain obstacles must still be addressed.

4.1 Moisture Sensitivity

Natural fibers tend to absorb moisture, leading to:

- Dimensional instability

- Reduced mechanical strength

Surface treatment and resin compatibility improvements are required.

4.2 Variable Fiber Quality

Natural fibers vary based on:

- Climate

- Soil conditions

- Harvesting techniques

This variability impacts consistency in final composite performance.

4.3 Competition from Synthetic Composites

Glass-fiber composites remain:

- Stronger

- More durable

- More mature in industrial applications

Bridging the performance gap remains a challenge.

4.4 Low Awareness in Emerging Markets

Lack of technical expertise and limited production facilities restrict NFRP adoption in developing regions.

5. Market Segmentation Overview

By Fiber Type

- Flax – high strength-to-weight ratio

- Hemp – excellent performance in automotive applications

- Jute – cost-effective, widely available in Asia

- Kenaf – strong thermal and acoustic properties

- Sisal – durable and highly tensile

By Polymer Type

- Thermoplastics (PP, PE, PLA) – dominant due to ease of processing

- Thermosets (epoxy, polyester) – used in high-strength applications

By End-Use Industry

- Automotive – largest segment

- Construction – rising adoption

- Packaging – rapid growth

- Consumer goods – sustainable electronics

- Aerospace – lightweight composites for interiors

6. Regional Market Analysis

6.1 Europe – Leading the Global Market

Driven by:

- Strict environmental regulations

- Strong automotive industry

- Investments in bio-based materials

- High demand for recyclable products

Germany, France, and the UK are key centers of innovation.

6.2 North America – Sustainability and Automotive Innovation

The U.S. and Canada are witnessing growth due to:

- Electric vehicle (EV) adoption

- Higher emphasis on sustainable manufacturing

- Government incentives for bio-material technologies

6.3 Asia-Pacific – Fastest-Growing Region

Factors include:

- Large-scale availability of natural fibers (India, Bangladesh, China)

- Growing construction and automotive industries

- Increased investment in biodegradable materials

6.4 Latin America and Middle East – Emerging Opportunities

Brazil’s strong agro-sector promotes fiber availability, while the Middle East focuses on sustainable construction.

7. Competitive Landscape

Key companies include:

- Advanced composites manufacturers

- Bio-material companies

- Polymer developers

- Automotive OEMs integrating NFRPs

Strategic initiatives involve:

- Partnerships with agriculture cooperatives

- Investments in fiber treatment facilities

- New resin development

- Eco-friendly product design

8. Future Outlook: What Will Shape the Market by 2032?

Looking ahead, several trends will redefine industry dynamics:

8.1 Integration with Electric Vehicles

EV manufacturers prefer lightweight materials for:

- Enhanced battery efficiency

- Extended driving range

This will significantly boost NFRP adoption.

8.2 Bio-Resin Innovations

Next-gen bio-resins will enhance:

- Strength

- Moisture resistance

- Durability

Making NFRPs more competitive with synthetic composites.

8.3 Increased Automation in Composite Manufacturing

Automated production lines will reduce costs and improve quality uniformity.

8.4 Circular Economy Integration

Recycling and composting technologies will enhance lifecycle sustainability.

8.5 Growing Role in Consumer Electronics

Tech companies are experimenting with NFRP-based:

- Laptop casings

- Smartphone covers

- Speakers

- Wearable devices

This emerging segment will contribute significantly to market expansion.

Conclusion

The Natural Fiber Reinforced Plastics Market is evolving rapidly, driven by global sustainability goals, industrial innovation, and regulatory support. As industries transition away from petroleum-based and synthetic materials, NFRPs offer a compelling alternative—combining eco-friendliness, performance, light weight, and cost efficiency.

With the market expected to grow from USD 9.98 Billion in 2024 to USD 24.36 Billion by 2032, the next decade will witness an accelerated shift toward natural fiber composites across automotive, construction, packaging, consumer goods, and aerospace sectors.

NFRPs are no longer niche materials—they are becoming essential building blocks of the future bio-based, circular global economy.

Source-https://www.credenceresearch.com/report/natural-fiber-reinforced-plastics-market

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness