Mexico Masterbatch Market Size, Share, In-Depth Analysis, Opportunity and Forecast 2025-2033

IMARC Group has recently released a new research study titled “Mexico Masterbatch Market Size, Share, Trends and Forecast by Type, Polymer Type, Application, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

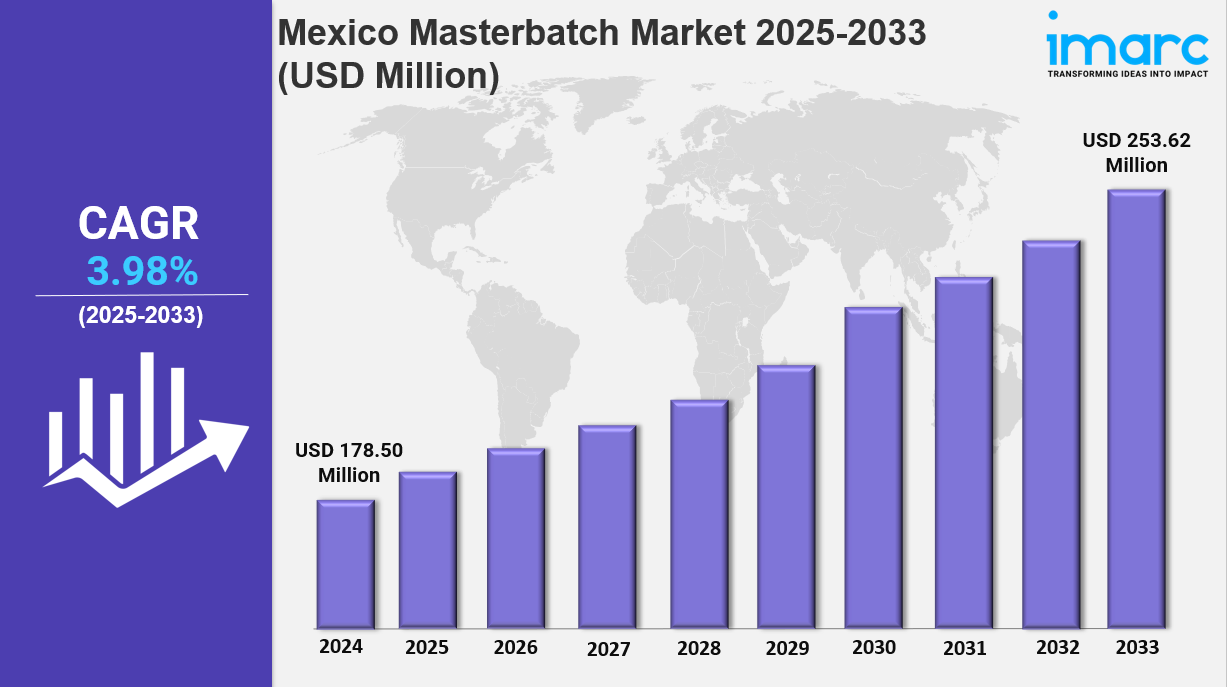

The Mexico masterbatch market size was USD 178.50 Million in 2024 and is expected to reach USD 253.62 Million by 2033, growing at a CAGR of 3.98% during the forecast period of 2025-2033. Market growth is driven by the rapid expansion of plastic packaging and automotive manufacturing, stringent environmental regulations promoting recycled-content additives, rising demand for high-performance color and functional masterbatches in construction and consumer goods, and technological advancements in customized formulations.

Study Assumption Years

-

Base Year: 2024

-

Historical Year/Period: 2019-2024

-

Forecast Year/Period: 2025-2033

Mexico Masterbatch Market Key Takeaways

-

Current Market Size: USD 178.50 Million in 2024

-

CAGR: 3.98% (2025-2033)

-

Forecast Period: 2025-2033

-

The automotive manufacturing sector in Mexico is expanding rapidly with domestic vehicle production exceeding 4 million units in 2023, boosting demand for color-consistent and lightweight plastics.

-

The packaging sector holds the largest share of masterbatch revenues, driven by growth in e-commerce and fast-moving consumer goods.

-

Investments have increased production capacity with three new extrusion lines planned in Monterrey and Guadalajara by mid-2025.

-

Environmental regulations such as Mexico City's Circular Economy Law (effective March 2023) are driving demand for bio-based and post-consumer recycled masterbatches.

-

Tax incentives introduced in mid-2024 promote investment in machinery for recycled content processing.

Sample Request Link: https://www.imarcgroup.com/mexico-masterbatch-market/requestsample

Mexico Masterbatch Market Growth Factors

The Mexico masterbatch market is experiencing robust growth fueled by several industry drivers. The automotive sector notably contributes, with domestic vehicle production surpassing 4 million units in 2023, especially in key manufacturing hubs such as Puebla, Guanajuato, and Nuevo León. Automakers' increasing requirement for lightweight, color-consistent plastics for interior and exterior applications is driving demand for specialty color and additive masterbatches. Concurrently, the packaging sector is expanding due to e-commerce and consumer goods growth, which contributes the largest share of masterbatch revenue and stimulates investments including new extrusion lines in Monterrey and Guadalajara by mid-2025.

Sustainability mandates are significantly influencing market dynamics. The enactment of Mexico City’s Circular Economy Law on March 1, 2023, bans many single-use plastics and implements minimum recycled-content thresholds and producer take-back schemes. This regulatory framework, supported by federal amendments, has accelerated demand for bio-based and post-consumer recycled (PCR) masterbatch solutions. The black masterbatch segment shows a pronounced shift toward eco-friendly grades outperforming conventional formulations. The recycled resin compounding capacity is projected to exceed 15,000 tonnes per annum by end of 2025, driven by increased PCR pellet supply, further boosting market growth.

Fiscal policies also support market expansion. Tax incentives introduced in mid-2024 provide credits for machinery dedicated to recycled content processing, encouraging new capital investments. Moreover, as Mexico targets its 2030 circular-economy objectives, compounding facilities are upgrading to twin-screw extruders capable of handling higher PCR volumes, achieving substantial CO₂ emissions reductions in masterbatch production. These developments are expected to enhance sustainability and operational efficiency, underpinning continued market growth through 2033.

Mexico Masterbatch Market Segmentation

Breakup By Type:

-

Color

-

White

-

Black

-

Additive

-

Filler

The market segmentation by type includes color and additive variants, as well as white, black, and filler masterbatches, detailing various usage forms in the industry.

Breakup By Polymer Type:

-

PP

-

LDPE/LLDPE

-

HDPE

-

PVC

-

PUR

-

PET

-

PS

-

Others

This segmentation provides detailed insights into the market share and trends related to polypropylene, polyethylene variants, PVC, polyurethane, PET, polystyrene and other polymers.

Breakup By Application:

-

Packaging

-

Building and Construction

-

Consumer Goods

-

Automotive

-

Textile

-

Agriculture

-

Others

The market is analyzed by diverse applications including packaging, construction, automotive, textiles, agriculture, and other consumer goods sectors.

Breakup By Region:

-

Northern Mexico

-

Central Mexico

-

Southern Mexico

-

Others

The report offers a comprehensive study of geographic market dynamics across the main regions of Mexico including Northern, Central, Southern, and additional areas.

Regional Insights

Northern Mexico is a dominant region reflecting strong market activity, supported by automotive manufacturing hubs and increasing extrusion line capacities. The region benefits from domestic vehicle production exceeding 4 million units in 2023 and key assembly plants in Puebla, Guanajuato, and Nuevo León. This regional strength, coupled with expansion in packaging demand and sustainability-focused investments, positions Northern Mexico as a pivotal market contributor in the forecast period.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=37050&flag=C

Recent Developments & News

In February 2025, UFlex announced a USD 50 million investment to establish a new manufacturing plant in Mexico, operational during FY 2025–26, aimed at producing 80 million recyclable woven polypropylene bags for dry pet food. These bags depend on masterbatches for consistent color, UV protection, and recyclability.

In March 2023, Mexico City’s Circular Economy Law was implemented to promote reuse, remanufacturing, and recycling. It introduced voluntary circularity assessments, a circularity label for compliant products (including masterbatches), and a public information system, highlighting the critical role of masterbatches in material reuse and recycling.

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness