Faster Payment Service (FPS) Market : Industry Analysis Trends and Forecast By 2029

Executive Summary Faster Payment Service (FPS) Market :

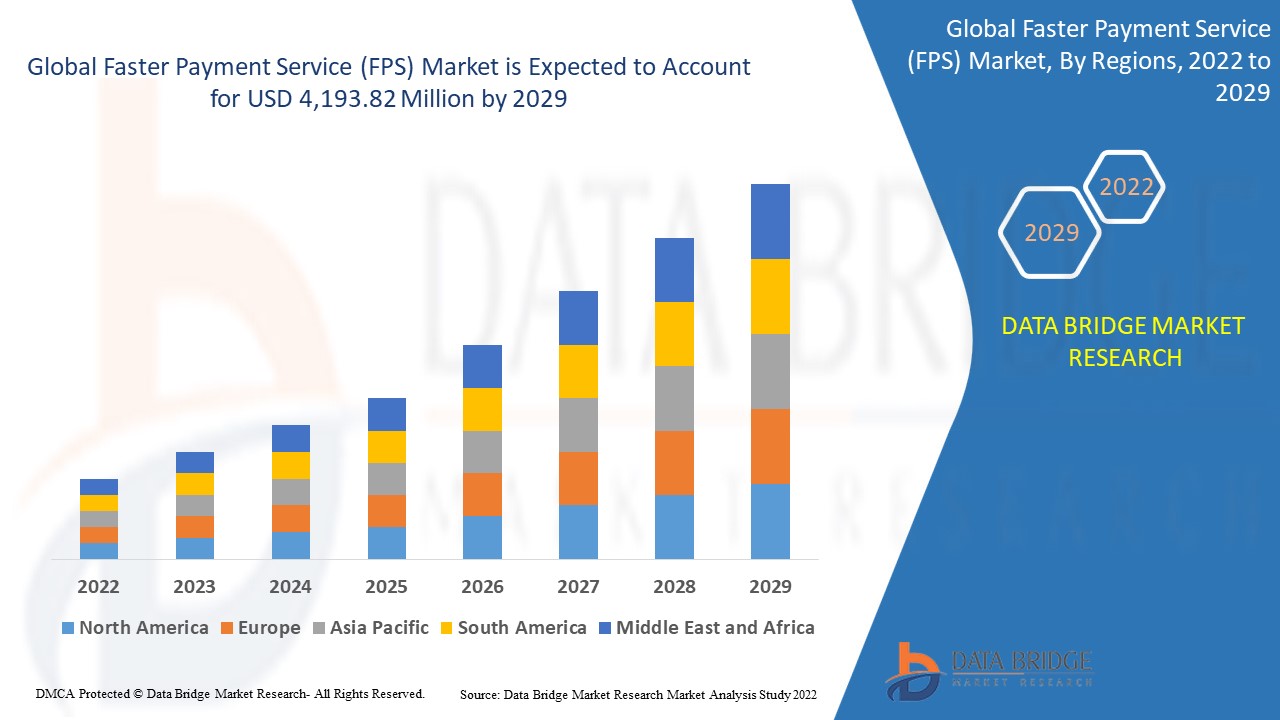

Global faster payment service (FPS) market was valued at USD 543.5 million in 2021 and is expected to reach USD 4,193.82 million by 2029, registering a CAGR of 29.10% during the forecast period of 2022-2029.

Business intelligence is an essential aspect when it comes to accomplish thorough and wide-ranging market insights and the same is applied for generating this Faster Payment Service (FPS) Market research report. The report offers CAGR value fluctuation during the forecast period of 2019 - 2025 for the market. Faster Payment Service (FPS) Market analysis gives an examination of various segments that are relied upon to witness the quickest development based on the approximated forecast frame. Not to mention, this market report delivers an exhaustive study with respect to present and upcoming opportunities which shed light on the future investment in the market.

The sources of data and information mentioned in the Faster Payment Service (FPS) Market report are very reliable and include websites, annual reports of the companies, journals, and mergers which are checked and validated by the market experts. The report can be used by both established and new players in the industry for complete understanding of the market. This market report is also sure to help in your journey to achieve the business growth and success. The precise and exact market research information provided through this Faster Payment Service (FPS) Market report will drive your business in the right direction.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Faster Payment Service (FPS) Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-faster-payment-service-fps-market

Faster Payment Service (FPS) Market Overview

**Segments**

- **Payment Type:**

- Real-Time Payments

- Immediate Payments

- Other Electronic Payments

- **Offering:**

- Payment Gateway

- Payment Processing

- Payment Security and Fraud Management

- Payment Monitoring

- Payment Analytics

- **Deployment Mode:**

- On-Premises

- Cloud

- **Organization Size:**

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

- **End-User:**

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- Healthcare

- IT and Telecom

- Others

The global Faster Payment Service (FPS) market is segmented based on various factors to provide a comprehensive view of the industry landscape. The segmentation based on payment type includes real-time payments, immediate payments, and other electronic payments. In terms of offerings, the market is segmented into payment gateway, payment processing, payment security and fraud management, payment monitoring, and payment analytics. Deployment mode segmentation covers on-premises and cloud-based solutions. Furthermore, organization size segments include small and medium-sized enterprises (SMEs) and large enterprises. Finally, the end-user segment encompasses industries such as banking, financial services, and insurance (BFSI), retail, healthcare, IT and telecom, among others.

**Market Players**

- Mastercard

- Visa Inc.

- Fidelity National Information Services, Inc.

- Capgemini

- Fiserv, Inc.

- Worldline

- ACI Worldwide, Inc.

- PayPal Holdings, Inc.

- Apple Inc.

- Ant Financial Services Group

The global Faster Payment Service (FPS) market includes key players that contribute significantly to the industry's growth and innovation. Companies such as Mastercard, Visa Inc., Fidelity National Information Services, Inc., and Capgemini are among the prominent market players driving the adoption of faster payment services worldwide. Additionally, Fiserv, Inc., Worldline, ACI Worldwide, Inc., PayPal Holdings, Inc., Apple Inc., and Ant Financial Services Group play crucial roles in shaping the competitive landscape of the FPS market. These market players offer a diverse range of solutions and services to meet the evolving payment needs of various industries and sectors.

The global Faster Payment Service (FPS) market is witnessing significant growth and evolution driven by various factors such as technological advancements, increasing digitalization, changing consumer preferences, and the need for efficient payment solutions. One key trend shaping the market is the rising demand for real-time payment solutions that offer instant and seamless transactions. With the growing emphasis on convenience and speed in financial transactions, the adoption of real-time payments is expected to gain momentum across industries such as BFSI, retail, and healthcare.

Moreover, the payment security and fraud management segment is becoming increasingly critical as cyber threats and fraud risks continue to pose challenges to the digital payment ecosystem. Market players are focusing on developing advanced security solutions to safeguard payment transactions and protect user data from potential breaches. This trend underscores the importance of integrating robust security measures within faster payment services to build trust among consumers and businesses.

In terms of deployment mode, cloud-based solutions are gaining traction due to their scalability, flexibility, and cost-effectiveness. Cloud deployment offers increased agility in managing payment services, enabling organizations to adapt to changing market conditions and scale operations as needed. As businesses strive for enhanced operational efficiency and reduced IT infrastructure costs, the adoption of cloud-based faster payment solutions is expected to surge in the coming years.

Furthermore, the differentiation in offerings such as payment analytics is playing a crucial role in enabling organizations to derive valuable insights from payment data. Payment analytics solutions empower businesses to optimize their payment processes, detect fraud patterns, and identify opportunities for revenue growth. By leveraging advanced analytics tools, companies can enhance decision-making, streamline operations, and drive business innovation in the competitive FPS market landscape.

Overall, the global FPS market is poised for continued growth and innovation as market players collaborate with industry stakeholders to enhance payment experiences, address regulatory requirements, and drive financial inclusion. With a diverse range of market players offering specialized solutions and services tailored to specific industry needs, the FPS market is set to witness dynamic developments that will shape the future of digital payments on a global scale.The global Faster Payment Service (FPS) market is experiencing a profound transformation driven by technological advancements and changing consumer behaviors. One of the key trends influencing the market is the increasing demand for real-time payment solutions that provide immediate and seamless transactions. This trend is fueled by the growing preference for convenient and efficient payment methods across industries such as banking, retail, and healthcare. As businesses and consumers alike seek faster and more secure payment options, the adoption of real-time payments is expected to continue on an upward trajectory, reshaping the landscape of financial transactions globally.

In parallel, the emphasis on payment security and fraud management within the FPS market is intensifying as cyber threats and fraudulent activities pose significant risks to the digital payment ecosystem. Market players are focusing on developing sophisticated security solutions to mitigate risks and protect sensitive payment data from breaches. The integration of robust security measures within faster payment services is crucial in building trust among stakeholders and ensuring the integrity of financial transactions, highlighting the importance of continuous innovation in safeguarding payment processes.

Furthermore, the deployment of cloud-based solutions is gaining momentum within the FPS market due to the scalability, flexibility, and cost-effectiveness they offer. Cloud deployment enables organizations to enhance agility in managing payment services, adapt to dynamic market conditions, and optimize operational efficiency. As businesses strive to streamline their operations and reduce IT infrastructure costs, the adoption of cloud-based faster payment solutions is projected to increase, driving greater efficiency and competitiveness in the market.

Moreover, the differentiation in offerings such as payment analytics is emerging as a critical factor in empowering organizations to extract actionable insights from payment data. Payment analytics solutions enable businesses to optimize their payment processes, detect fraudulent activities, and uncover opportunities for revenue growth. By leveraging advanced analytics tools, companies can make informed decisions, enhance operational excellence, and foster innovation in the increasingly competitive FPS market landscape.

Overall, the global FPS market is poised for sustained growth and innovation as industry players collaborate to enhance payment experiences, comply with regulatory standards, and promote financial inclusion. With a diverse portfolio of specialized solutions tailored to specific industry requirements, the FPS market is set to witness dynamic advancements that will shape the future of digital payments on a global scale, driving greater efficiency, security, and convenience in financial transactions.

The Faster Payment Service (FPS) Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-faster-payment-service-fps-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

How Faster Payment Service (FPS) Market Report Would Be Beneficial?

- Anyone who are directly or indirectly connected in value chain of Faster Payment Service (FPS) Market industry and needs to have Know-How of market trends

- Marketers and agencies doing their due diligence

- Analysts and vendors looking for Faster Payment Service (FPS) Market intelligence about Faster Payment Service (FPS) Market Industry

- Competition who would like to correlate and benchmark themselves with market position and standings in current scenario

Browse More Reports:

Global Newborn Screening Market

Global Financial Crime and Fraud Management Solutions Market

India, Malaysia, and Indonesia Modular Kitchen Market

Middle East and Africa Hydrochloric Acid Market

Global Tangerine Essential Oil Market

Global Papillary Thyroid Cancer Market

Global Organic Seed Market

Asia-Pacific Heart Valve Repair and Replacement Market

Middle East and Africa Edible Oil Market

Global Octreotide Market

Global Bilayer Membrane Heterojunction Organic Solar Cell (OPV) Market

Asia-Pacific Submental Fat Treatment Market

Global Internet of Things (IoT) Operating Systems Market

North America Newborn Screening Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness