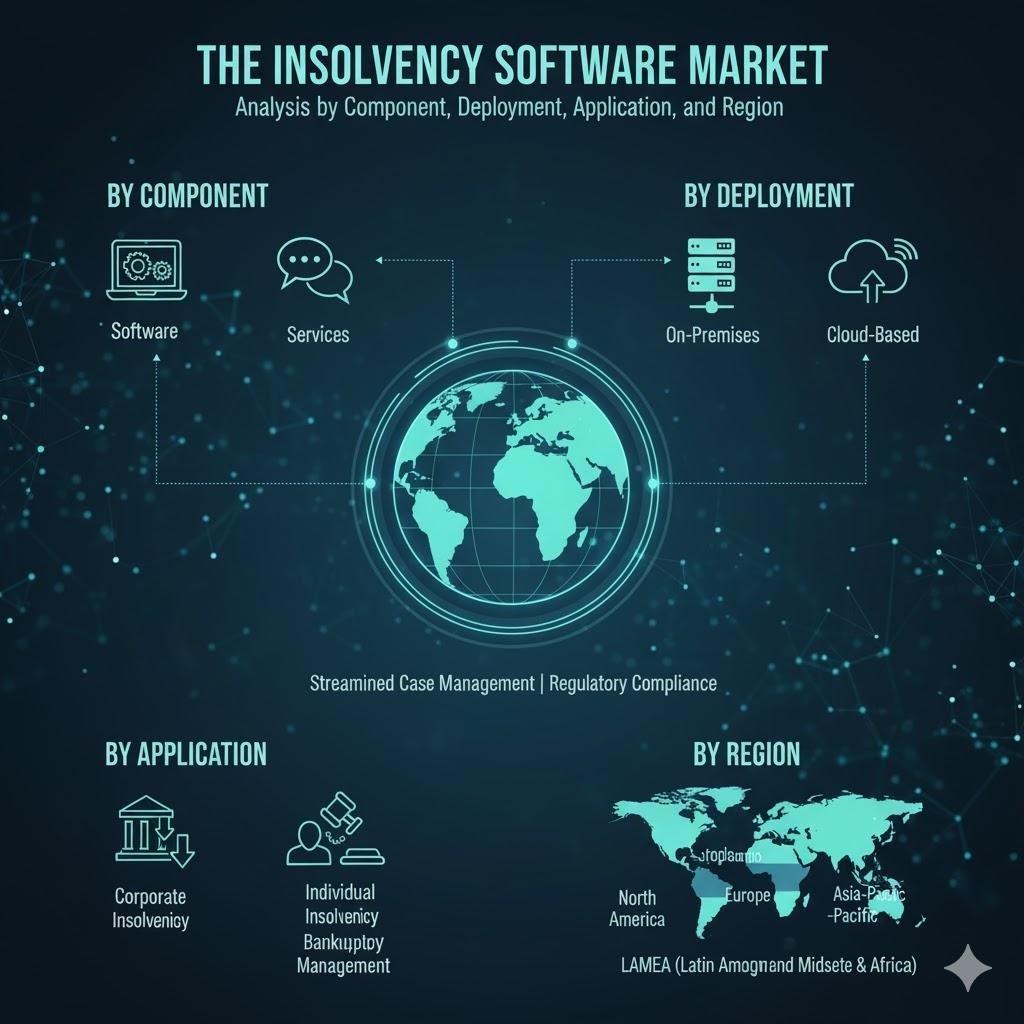

The Insolvency Software Market (2024-2032): Analysis by Component, Deployment, Application, and Region

The Insolvency Software Market (2024-2032): Analysis by Component, Deployment, Application, and Region

The Insolvency Software Market refers to the global industry that develops, sells, and supports specialized software solutions designed to manage the entire process of insolvency and bankruptcy cases. It's the ecosystem of technology tools that help professionals handle what happens when a company or individual cannot pay their debts.

According to Credence Research the insolvency software market size was valued at USD 2.03 billion in 2024 and is anticipated to reach USD 4.6 billion by 2032, at a CAGR of 10.8% during the forecast period (2024-2032).

Source: https://www.credenceresearch.com/report/insolvency-software-market

Executive Summary

The global insolvency software market is poised for significant growth from 2024 to 2032, driven by a complex interplay of economic factors, increasing regulatory demands, and a pressing need for operational efficiency within the insolvency and restructuring industry. This market encompasses specialized technology solutions that automate and streamline the entire lifecycle of insolvency cases, from initial filing and creditor communication to asset distribution and compliance reporting.

The period will be characterized by a decisive shift from legacy, on-premises systems towards cloud-based and hybrid deployment models, offering scalability, remote accessibility, and enhanced security. Key growth segments include software components for core functionality and services for implementation and support, with applications in case management and compliance tracking leading the demand. Geographically, while North America remains a mature and dominant market, the Asia-Pacific region is expected to exhibit the highest growth rate due to economic expansion and evolving bankruptcy frameworks.

Market Definition and Scope

Insolvency software is a suite of tools designed specifically for insolvency practitioners, law firms, and financial institutions to manage the administrative, financial, and legal complexities of corporate and personal bankruptcy proceedings. Its core functions include:

- Case Management: Centralizing all case-related information.

- Financial Tracking: Managing creditor claims, asset realization, and distributions.

- Compliance & Reporting: Ensuring adherence to stringent local and international insolvency laws and generating statutory reports.

- Stakeholder Communication: Facilitating secure and auditable communication with creditors, debtors, and courts.

Market Dynamics

Growth Drivers

- Rising Global Insolvency Cases: Economic volatility, high-interest rates, and the aftermath of pandemic-related support measures are leading to an increase in corporate and personal insolvencies, directly driving the demand for efficient management tools.

- Regulatory Complexity: Insolvency regimes (e.g., Chapter 11 in the U.S., Insolvency Act in the UK) are complex and constantly evolving. Software is essential to ensure compliance, avoid penalties, and manage tight deadlines.

- Demand for Operational Efficiency: Manual processes are time-consuming, error-prone, and costly. Software automates tasks like document generation, dividend calculations, and reporting, freeing up practitioners for higher-value advisory work.

- Digital Transformation of Legal & Financial Sectors: The broader trend towards digitization pushes firms to adopt modern software solutions to remain competitive and meet client expectations for transparency and speed.

Key Restraints

- High Initial Investment: The cost of licensing and implementing sophisticated software can be a barrier for small and medium-sized practices.

- Data Security and Privacy Concerns: Insolvency cases involve highly sensitive financial data. Concerns about data breaches and cloud security can slow adoption, though vendors are countering this with robust, certified security protocols.

- Resistance to Change: Legacy systems and ingrained manual processes within traditional firms can lead to resistance in adopting new technologies.

Emerging Opportunities

- Integration of AI and Machine Learning: AI can be used for predictive analytics (assessing the likelihood of restructuring success), automated document review, and identifying patterns in large datasets of creditor claims.

- Adoption of Blockchain: Blockchain technology offers potential for immutable audit trails, smart contracts for automatic distributions, and enhanced security and transparency in the insolvency process.

- Growth in Emerging Economies: As countries like India, China, and Brazil reform their insolvency and bankruptcy codes, a new market for modern software solutions is being created.

Market Segmentation Analysis

3.1. By Component

- Software:

- Dominant Segment: Holds the largest market share as it is the core product.

- Characteristics: Includes perpetual licenses and subscription-based (SaaS) models. The trend is strongly towards SaaS due to lower upfront costs and automatic updates.

- Services:

- Fastest-Growing Segment: As software becomes more complex and integrated, the need for services increases.

- Sub-segments:

- Implementation & Integration Services: Crucial for onboarding and connecting the software with existing systems (e.g., accounting, CRM).

- Training & Consulting: Essential for user adoption and optimizing the use of software features.

- Support & Maintenance: Ensures system reliability and addresses technical issues.

3.2. By Deployment Model

- Cloud-Based:

- Highest Growth Segment: Valued for its scalability, cost-effectiveness (OPEX model), and remote accessibility, which supports hybrid work models.

- Advantages: Automatic updates, disaster recovery, and reduced IT overhead.

- On-Premises:

- Legacy Segment: Still preferred by large, security-conscious organizations (e.g., major banks, large law firms) that want direct control over their servers and data.

- Disadvantages: High upfront capital expenditure (CAPEX) and responsibility for maintenance and security.

- Hybrid:

- Emerging Model: Offers a middle ground, allowing firms to keep highly sensitive data on-premises while leveraging the cloud for less critical applications or for backup and analytics.

3.3. By Application

- Case Management:

- Largest Application Segment: The central nervous system of insolvency software. It is non-negotiable for organizing debtor information, deadlines, court dates, and creditor communications.

- Compliance Tracking:

- Critical Application Segment: Automates the tracking of statutory deadlines, regulatory changes, and required reporting, significantly reducing compliance risk.

- Reporting:

- High-Value Application: Enables the generation of standardized and custom reports for courts, creditors, and regulators. Advanced analytics provide insights into case performance and portfolio trends.

- Communication:

- Efficiency-Focused Application: Provides secure portals for mass creditor communication, document sharing, and e-voting, creating an auditable record of all interactions.

Regional Analysis

- North America:

- Largest Market in 2024: Mature market with a well-established insolvency framework (High adoption of advanced technologies and the presence of major software vendors.

- Driver: High volume of complex corporate restructurings.

- Europe:

- Mature and Steady Market: Strong growth driven by regulatory harmonization efforts across the EU and the UK's active insolvency market.

- Driver: Increasing use of pre-insolvency procedures and a focus on cross-border insolvency cases.

- Asia-Pacific (APAC):

- Fastest-Growing Market: Rapid growth fueled by economic development, the introduction of new insolvency codes (e.g., India's Insolvency and Bankruptcy Code, 2016), and a rising number of corporate defaults.

- Driver: Digital transformation initiatives and the growing professionalization of the insolvency practitioner industry.

- Latin America, Middle East & Africa:

- Emerging Markets: Smaller but growing from a low base. Growth is tied to economic reforms and modernization of legal frameworks. Adoption is initially focused on major financial centers and large firms.

Competitive Landscape (2024-2032)

The market is moderately fragmented, featuring a mix of:

- Global Niche Specialists: Companies that focus exclusively on insolvency and legal practice management software (e.g., APS, Caseware International).

- Large Legal Tech Providers: Broader legal technology companies that offer insolvency modules within their suite.

- Emerging SaaS Start-ups: Agile companies offering modern, user-friendly, cloud-native solutions.

Competitive Strategies will include:

- Product Innovation: Integrating AI, analytics, and automation.

- Strategic Partnerships: Collaborating with law firms and accounting bodies.

- Mergers & Acquisitions: Consolidating to gain market share and new technologies.

- Geographic Expansion: Targeting high-growth regions like APAC.

Conclusion & Outlook (2024-2032)

The insolvency software market is on a robust growth trajectory, transitioning from a niche tool to a critical business necessity. The forecast period will be defined by:

- The "Cloud-First" Imperative: Cloud deployment will become the standard.

- The Intelligence Leap: AI and data analytics will transform the role of practitioners from administrators to strategic advisors.

- Globalization of Best Practices: As emerging markets adopt sophisticated software, global standards for insolvency administration will rise.

Firms that invest in modern, scalable, and intelligent insolvency software platforms will be best positioned to manage increasing caseloads efficiently, mitigate compliance risks, and succeed in a increasingly competitive and digitally-driven landscape.

Source: https://www.credenceresearch.com/report/insolvency-software-market

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness