Laboratory Developed Tests Market Report: Key Drivers, Challenges, and Regional Analysis

Market Overview

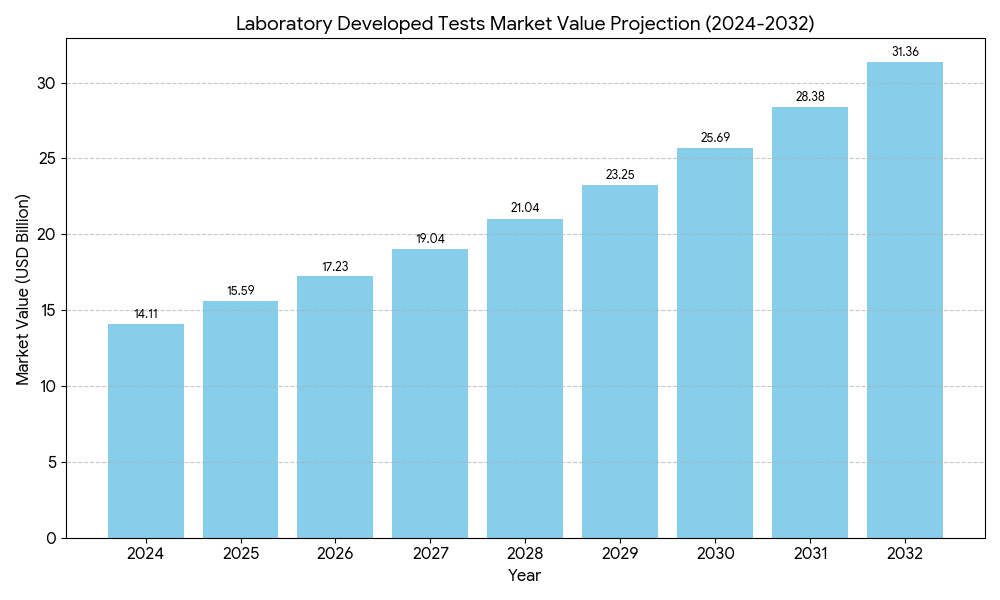

The Laboratory Developed Tests Market was valued at USD 14.11 billion in 2024 and is projected to reach USD 31.35 billion by 2032, growing at a CAGR of 10.5%, as per Credence Research. This growth is driven by the rising demand for personalized diagnostics, oncology profiling, and rapid assay deployment. Laboratories leverage next-generation sequencing, molecular platforms, AI, and digital workflows to shorten turnaround time and improve accuracy. Growing demand for genetic screening and flexibility in test design further support adoption across hospitals, reference labs, and biopharma customers.

Source: https://www.credenceresearch.com/report/laboratory-developed-tests-market

Market Drivers

Clinical Demand and Personalized Medicine

Growing demand for targeted therapies and patient-specific care propels the Laboratory Developed Tests Market. Clinics and oncologists prefer tailored assays for tumor profiling and pharmacogenomics, which improve treatment decisions and outcomes. High clinical need for rare-disease diagnostics and speed of in-house assay deployment encourage hospitals and reference labs to adopt LDTs. Investment in genomic platforms and bioinformatics expands test portfolios and clinical utility.

Technology Adoption and Operational Efficiency

Advances in molecular platforms, automation, and AI support higher throughput and better result interpretation. It lowers per-test time and improves reproducibility across complex assays. Labs gain flexibility to validate novel markers before commercial kits appear, preserving clinical access in unmet areas. Reimbursement for high-complexity tests and partnerships with sequencing vendors further strengthen provider economics.

Market Trends and Opportunities

Decentralized Testing and Near-Patient Models

Shift toward decentralized diagnostics opens new channels for the Laboratory Developed Tests Market. Community hospitals and specialty clinics adopt near-patient LDTs to reduce referrals and speed clinical decisions. Digital reporting and telehealth integration improve patient follow-up. Expansion into emerging markets where commercial kits lag creates revenue opportunities for regional labs and start-ups.

AI, NGS, and Companion Diagnostics

Integration of AI with NGS data creates actionable insights for precision oncology and minimal residual disease detection. It strengthens LDT value proposition versus standardized IVDs. Collaborations between sequencing firms and clinical labs unlock co-development pathways and companion diagnostics, supporting higher-margin services and clinical trial partnerships.

Market Challenges

Regulatory Uncertainty and Compliance Costs

Evolving regulation imposes uncertainty on the Laboratory Developed Tests Market and raises compliance expenses for smaller labs. Increased oversight proposals have prompted legal challenges and operational review across U.S. labs. It forces investment in quality systems, adverse-event reporting, and potential premarket submissions, which pressure margins for decentralized providers. Strategic planning must include regulatory scenario analysis.

Reimbursement Limits and Standardization Gaps

Inconsistent reimbursement for novel assays and lack of harmonized standards constrain broader adoption. Payers require clinical utility evidence, while smaller labs face hurdles generating large outcome studies. Variation across regions in validation requirements complicates multi-market rollouts and slows scale for innovative tests. Partnerships with payers and real-world evidence generation remain essential to overcome these barriers.

Key Players

· QIAGEN

· Siemens Healthineers AG

· Illumina, Inc.

· Abbott Laboratories

· Quest Diagnostics Incorporated

· Guardant Health

· F. Hoffmann-La Roche Ltd. (Roche)

· NeoGenomics Laboratories

· 23andMe, Inc.

· Thermo Fisher Scientific

Regional Insights

North America (47.2%) – Established clinical labs, high healthcare spending, and CLIA framework drive dominant share. The U.S. leads in oncology and genomic LDT adoption with strong reimbursement support.

Europe (24.5%) – Strong academic research and IVDR influence lab validation. Germany, the UK, and the Netherlands lead in genomics and population screening initiatives.

Asia-Pacific (17.3%) – Rapid hospital network expansion, government genomics programs, and rising disease burden fuel growth. China, India, and Japan emerge as key markets.

Latin America (6.1%) – Urban centers adopt LDTs to fill gaps where commercial kits lag. Public-private initiatives and academic labs drive adoption.

Middle East & Africa (4.9%) – GCC investments and selective national programs support molecular labs, though uneven access and reimbursement remain challenges.

Competitive Analysis

The Laboratory Developed Tests Market features intense competition among technology vendors and clinical laboratories. Major players such as QIAGEN, Illumina, Siemens Healthineers, Roche, and Quest Diagnostics compete on platform accuracy, turnaround time, clinical validation, and partnerships. It favors firms that combine sequencing or molecular platforms with strong lab networks and payer relationships, while smaller specialized labs compete on niche assays, faster deployment, and flexible service models. Strategic alliances and clinical evidence differentiate leaders in the market.

Go-To Market Strategy

The Laboratory Developed Tests Market focuses on clear clinical value, fast turnaround, and validated performance. Companies prioritize oncology and rare-disease assays where clinical need is high, secure key opinion leader endorsements, and publish real-world evidence to support reimbursement. Partnerships with sequencing vendors and reference labs enhance scalability. Targeted marketing to oncology centers and biopharma segments helps drive adoption. It emphasizes regulatory readiness and lab accreditation to strengthen buyer confidence.

Recent Developments

1. FDA published a rule in 2024 increasing oversight for LDTs, prompting industry-wide reviews.

2. Legal challenges in 2025 led to potential rollback of the FDA’s LDT oversight rule, creating regulatory uncertainty.

3. Credence Research projected market growth from USD 14.11 billion in 2024 to USD 31.35 billion by 2032.

4. Labs are integrating AI and NGS platforms to support companion diagnostics and oncology-focused assays.

5. Guardant Health reported higher test volumes in 2023, signaling expanded LDT adoption in oncology diagnostics.

Future Outlook

Investment in genomic platforms, AI, and decentralized workflows will sustain growth in the Laboratory Developed Tests Market. Demand will shift toward higher-value companion diagnostics and disease-monitoring assays that improve therapy selection. Strategic collaborations between sequencing vendors, clinical labs, and biopharma will open new commercial pathways. Regulatory clarity and better reimbursement frameworks will define future adoption across global markets.

Frequently Asked Questions

What is the current market size of the Laboratory Developed Tests Market?

It was valued at USD 14.11 billion in 2024.

What factors are driving the growth of the Laboratory Developed Tests Market?

Personalized medicine, oncology profiling, and rapid in-house assay deployment drive expansion.

Which region leads the Laboratory Developed Tests Market?

North America leads with a 47.2% share in 2024.

What major challenge affects the Laboratory Developed Tests Market?

Regulatory uncertainty and inconsistent reimbursement policies impact smaller labs.

Source: https://www.credenceresearch.com/report/laboratory-developed-tests-market

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness