Active vs. Passive Fixed Income Strategies: What’s Powering the Next Decade of Asset Management?

Figure 1: A conceptual image comparing two investment strategies: a vibrant, dynamic abstract representation of Active Fixed Income on one side, and a stable, structured graphical representation of a market index for Passive Fixed Income on the other, connected by financial data streams.

Introduction: The Evolving Landscape of Fixed Income Investing

In a rapidly shifting global economy, the Fixed Income Asset Management Market has emerged as a cornerstone of modern portfolio construction. With investors seeking diversification, risk management, and stable returns, fixed income instruments such as government bonds, corporate bonds, and high-yield debt continue to play a pivotal role in balancing volatility and preserving capital.

According to Credence research, valued at USD 85,988.1 billion in 2024, the global Fixed Income Asset Management Market is projected to reach USD 185,667.9 billion by 2032, growing at a CAGR of 10.1%. This strong trajectory reflects deep institutional participation from pension funds, insurers, and sovereign wealth funds, as well as expanding retail interest driven by passive investing and sustainable finance.

At the heart of this transformation lies an enduring debate: active vs. passive fixed income strategies. As both approaches evolve through digital integration, ESG mandates, and macroeconomic challenges, understanding their interplay is crucial for investors and policymakers navigating the next decade of asset management.

Source: Fixed Income Asset Management Market Size, Share and Forecast 2032

1. Understanding Fixed Income Asset Management

Fixed income asset management involves the strategic allocation of capital to debt instruments that provide regular income payments and capital preservation. These assets include government bonds, corporate bonds, municipal bonds, mortgage-backed securities (MBS), and high-yield bonds.

The appeal lies in stability while equities fluctuate with market sentiment, fixed income assets offer predictable cash flows and defined maturity values. In a global environment marked by inflation, geopolitical uncertainty, and monetary tightening, fixed income strategies anchor portfolios against volatility.

Institutional investors, particularly pension funds and insurers, rely on fixed income to match long-term liabilities, maintain liquidity, and hedge against market downturns. Sovereign wealth funds, too, diversify into bonds to balance risk exposure across global markets.

2. Market Dynamics: What’s Fueling Growth?

The fixed income asset management industry is undergoing profound transformation, driven by several converging factors:

2.1 Demand for Portfolio Diversification

As equity markets experience volatility due to inflationary pressures and monetary policy shifts, investors increasingly turn to bonds for portfolio balance and income stability.

2.2 Risk Management and Capital Preservation

Fixed income serves as a defensive asset class, offering security of principal and predictable yields attributes that are vital for pension liabilities, insurance portfolios, and endowment funds.

2.3 Institutional Allocation Surge

Pension funds, insurers, and sovereign wealth funds allocate substantial portions of their portfolios often 40% to 70% to fixed income products, emphasizing long-term stability and income consistency.

2.4 Sustainable Finance Momentum

A major trend reshaping the market is the rise of ESG (Environmental, Social, and Governance) integration. The growth of green bonds, social bonds, and sustainability-linked bonds (SLBs) has attracted institutional inflows, as investors seek both returns and responsible impact.

2.5 Digital Transformation and Product Innovation

Asset managers are leveraging data analytics, AI-driven risk models, and blockchain technology for efficient execution, transparency, and customized solutions. Digital bond issuance platforms and fixed income ETFs have democratized access for retail investors as well.

3. Active Fixed Income Strategies: The Search for Alpha

3.1 Definition and Philosophy

Active fixed income management involves actively selecting, timing, and weighting securities to outperform a benchmark index. Fund managers analyze macroeconomic data, credit spreads, interest rate trends, and issuer fundamentals to seek excess returns (alpha).

3.2 Techniques and Tools

- Duration and Yield Curve Management: Adjusting portfolio maturity based on expected rate changes.

- Credit Analysis: Evaluating creditworthiness to exploit spread differentials.

- Sector Rotation: Allocating between government, corporate, and high-yield bonds based on market cycles.

- Currency Hedging: Managing FX exposure for global bond portfolios.

- Tactical Asset Allocation: Shifting exposure dynamically to capture short-term opportunities.

3.3 Advantages

- Flexibility to respond to changing market conditions.

- Ability to outperform benchmarks in volatile environments.

- Customization for specific risk-return objectives.

3.4 Limitations

- Higher management costs and fees.

- Performance dependency on manager skill.

- Potential underperformance in low-volatility or rising-rate environments.

3.5 Market Adoption

Active strategies remain dominant among institutional investors, especially those seeking liability-driven investment (LDI) solutions. Managers like Allianz Global Investors, Fidelity International, and Schroders deploy active bond strategies integrating macroeconomic forecasts and quantitative credit models.

4. Passive Fixed Income Strategies: Simplicity and Scale

4.1 Definition and Approach

Passive fixed income investing aims to replicate the performance of a benchmark index, such as the Bloomberg Global Aggregate Bond Index or the U.S. Treasury Index. It relies on Exchange-Traded Funds (ETFs) and index funds for diversified exposure.

4.2 Growth Drivers

- Cost Efficiency: Lower expense ratios compared to active funds.

- Transparency: Predictable returns aligned with the index.

- Liquidity: ETFs provide intraday trading flexibility.

- Digital Accessibility: Online platforms have democratized fixed income exposure for retail investors.

4.3 Benefits

- Attractive for long-term, low-cost investors.

- Reduces reliance on manager skill.

- Aligns with fiduciary goals of cost minimization and compliance.

4.4 Limitations

- Limited ability to adapt to macro shifts or credit events.

- Exposure to index concentration risk.

- Potential tracking error in illiquid markets.

4.5 Market Expansion

Global leaders like Vanguard, BlackRock’s iShares, and State Street Global Advisors (SSGA) dominate the passive fixed income landscape. Their ETFs—tracking corporate, sovereign, and green bond indices—have seen massive inflows, particularly in low-yield environments.

5. Active vs. Passive: Strategic Balancing in Modern Portfolios

The future of fixed income investing lies not in the dominance of one approach over the other, but in their synergistic coexistence.

5.1 Hybrid Portfolios

Many institutional portfolios now employ a core-satellite strategy—a passive “core” of diversified index-tracking bonds complemented by active “satellites” targeting alpha through tactical or high-yield allocations.

5.2 Performance Trends

Historically, active fixed income strategies have demonstrated outperformance in volatile or tightening rate cycles, while passive approaches excel during stable and low-rate periods.

5.3 Cost vs. Customization

Passive funds appeal through cost savings, but active strategies deliver customized solutions for complex institutional needs—particularly in credit risk, liability matching, and duration targeting.

5.4 The ESG Factor

Both strategies are integrating sustainability screening. Active managers lead in impact measurement and engagement, while passive providers expand ESG bond indices to offer sustainable exposure at scale.

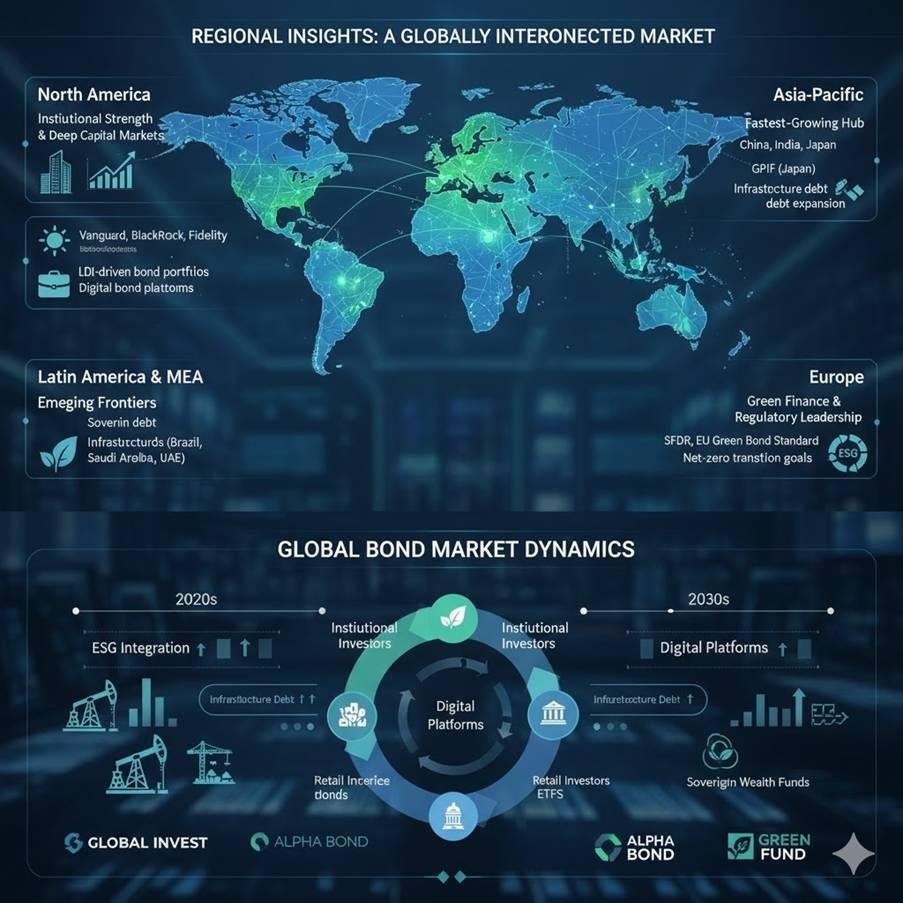

6. Regional Insights: A Globally Interconnected Market

Figure 2: A collage of global landmarks and financial data visualizations representing the worldwide fixed income market, highlighting North America, Europe's green finance, and the fast-growing Asia-Pacific region.

6.1 North America: Institutional Strength and Deep Capital Markets

North America remains the dominant region, benefiting from advanced capital markets, strong institutional participation, and deep liquidity in U.S. Treasuries and corporate bonds. The presence of major asset managers Vanguard, BlackRock, and Fidelity consolidates its leadership.

Institutional investors rely heavily on LDI-driven bond portfolios, while retail investors favor bond ETFs for diversification. The U.S. also leads in digital bond platforms, enhancing transparency and execution speed.

6.2 Europe: Green Finance and Regulatory Leadership

Europe ranks second, driven by regulatory reforms, green finance leadership, and ESG integration. The region’s Sustainable Finance Disclosure Regulation (SFDR) and EU Green Bond Standard have spurred massive inflows into sustainability-linked bonds and ESG-focused portfolios.

Asset managers like Allianz Global Investors, Schroders, and Amundi are at the forefront of sustainable fixed income innovation balancing active and passive frameworks aligned with net-zero transition goals.

6.3 Asia-Pacific: Fastest-Growing Hub of Fixed Income Expansion

The Asia-Pacific (APAC) region is experiencing the fastest growth, supported by the expanding economies of China, India, and Japan. Institutional investors are increasing allocations to bonds to manage volatility and stabilize returns amid regional market liberalization.

Japan’s Government Pension Investment Fund (GPIF) the world’s largest illustrates institutional strength, while China’s deepening bond market and India’s infrastructure debt expansion attract global capital.

6.4 Latin America and Middle East & Africa: Emerging Frontiers

Though smaller in share, Latin America and Middle East & Africa (MEA) are expanding rapidly through sovereign debt issuance, infrastructure bonds, and growing investor diversification.

In regions like Brazil, Saudi Arabia, and UAE, governments issue green and infrastructure-linked bonds to finance long-term projects. Sovereign wealth funds are also increasing fixed income allocations to stabilize revenue from commodity cycles.

7. Key Market Players and Competitive Strategies

7.1 Vanguard

Pioneering passive fixed income ETFs, Vanguard continues to expand low-cost products for both institutional and retail investors, maintaining transparency and scale advantages.

7.2 Allianz Global Investors

Allianz focuses on active fixed income strategies, combining macroeconomic insight and ESG integration. It tailors solutions for liability management and sustainable objectives.

7.3 Fidelity International

Fidelity blends active credit research with quantitative modeling, focusing on long-term alpha generation and customized institutional solutions.

7.4 Schroders

Schroders leads innovation in sustainable bond portfolios and impact investing, integrating carbon reduction metrics and social impact indicators into its active mandates.

7.5 Emerging Competitors

Other key participants—PIMCO, BlackRock, Amundi, Franklin Templeton, and T. Rowe Price compete on digitalization, customization, and global reach, introducing AI-driven analytics for real-time risk monitoring.

8. Challenges in the Fixed Income Asset Management Market

Despite its size and sophistication, the market faces several structural and macroeconomic challenges:

8.1 Interest Rate Volatility

Fluctuating interest rates driven by central bank policies impact bond valuations and portfolio yields, particularly for long-duration assets.

8.2 Inflationary Pressures

Persistent inflation erodes real returns, forcing managers to rebalance toward inflation-linked securities and shorter-duration assets.

8.3 Liquidity Constraints

In emerging markets, limited trading depth and regulatory restrictions can hinder efficient execution and increase transaction costs.

8.4 Credit and Default Risks

Corporate and high-yield bonds remain vulnerable to credit downgrades, especially during economic downturns.

8.5 Technology and Compliance Costs

Digital transformation enhances efficiency but also raises cybersecurity and regulatory compliance expenditures for global firms.

9. Future Outlook: The Next Decade of Fixed Income Asset Management

The next decade will redefine fixed income investing through technology, sustainability, and hybridization:

9.1 Rise of Smart Beta and Factor Investing

Smart beta strategies bridging active and passive approaches—will gain traction, using rule-based models to enhance returns while maintaining cost efficiency.

9.2 AI and Predictive Analytics

AI-driven credit scoring, machine learning models, and real-time portfolio optimization will enhance active management capabilities and risk forecasting.

9.3 Growth of ESG and Green Bonds

ESG considerations will remain central, with green, social, and sustainability-linked bonds growing exponentially as investors align financial performance with impact outcomes.

9.4 Digital Bond Platforms

Blockchain-based bond issuance and tokenization will democratize access and improve transparency across both institutional and retail segments.

9.5 Blending Strategies for Optimal Outcomes

Hybrid portfolios combining passive scale and active insight will dominate, offering investors adaptive strategies for dynamic market environments.

10. Conclusion: Balancing Efficiency with Expertise

The Fixed Income Asset Management Market stands at a critical juncture. With global assets projected to exceed USD 185 trillion by 2032, investors face the challenge of navigating interest rate cycles, inflation, and sustainability imperatives while optimizing returns.

The debate between active and passive fixed income strategies is less about rivalry and more about complementarity. Active management delivers flexibility and alpha potential, while passive solutions provide cost efficiency and stability. The future will favor hybrid frameworks strategies that blend human insight, data intelligence, and sustainable finance principles.

As asset managers embrace digital innovation, ESG mandates, and institutional collaboration, the next decade will redefine not only how bonds are managed but how capital is mobilized toward a more resilient, inclusive, and sustainable financial system.

Source: Fixed Income Asset Management Market Size, Share and Forecast 2032

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness