UK Cell and Gene Therapy CDMO Market Poised for Explosive Growth: Reaching USD 287.57 Million by 2032, Driven by Advanced Therapies and Digitalization

Discover how the UK Cell and Gene Therapy CDMO Market, valued at USD 80.13 million in 2024, is forecast to skyrocket to USD 287.57 million by 2032, driven by a 16.14% CAGR. Learn about the impact of growing demand for advanced therapeutics, expanding biopharma collaborations, technological advancements in manufacturing, and strong UK regulatory support. Gain critical insights from Credence Research. on regional dominance, clinical service demand, and the future of personalized medicine.

The United Kingdom has firmly cemented its position as a global nexus for life sciences, and nowhere is this more evident than in the burgeoning field of Cell and Gene Therapy (CGT). The sophisticated support provided by Contract Development and Manufacturing Organizations (CDMOs) is the engine powering this revolution. A comprehensive analysis by Credence Research. reveals an extraordinary growth trajectory for this critical sector.

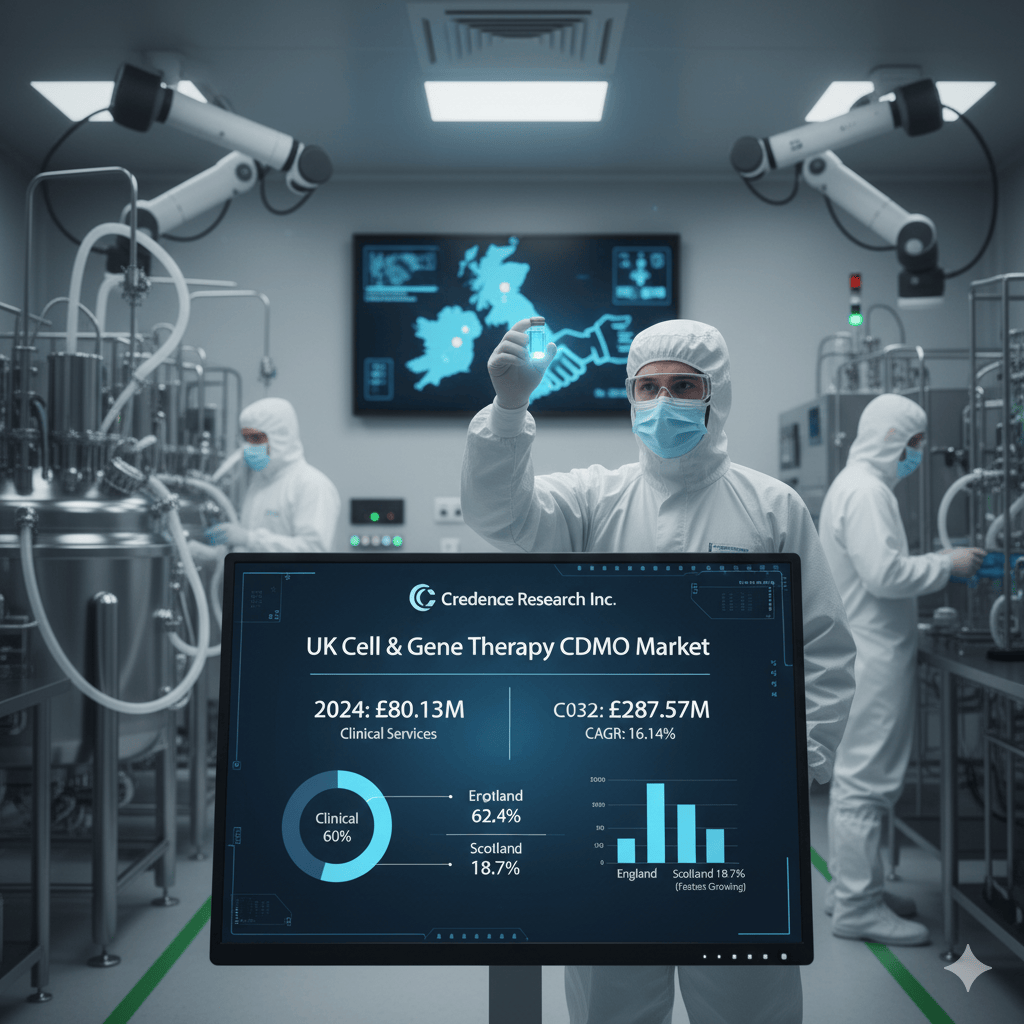

The UK Cell and Gene Therapy CDMO Market was valued at USD 26.16 million in 2018, rapidly accelerating to USD 80.13 million in 2024. Projections are equally staggering, anticipating the market will reach a massive USD 287.57 million by 2032. This phenomenal expansion is forecasted at a Compound Annual Growth Rate (CAGR) of 16.14% over the forecast period (2025-2032), underscoring the indispensable role of CDMOs in bringing life-saving advanced therapeutics to patients. This unparalleled growth trajectory firmly positions the UK as the undisputed leader in Europe for CGT manufacturing.

The market’s dynamism is not just a reflection of financial growth but a deep-seated transformation fueled by technological innovation, strategic expanding biopharma collaborations, and powerful government backing.

Source: https://www.credenceresearch.com/report/uk-cell-and-gene-therapy-cdmo-market

Market Drivers: The Forces Propelling UK CDMO Leadership

The remarkable anticipated growth, meticulously detailed by Credence Research Inc., is the result of several mutually reinforcing drivers that have created a uniquely fertile ground for Cell and Gene Therapy CDMOs in the UK.

Growing Demand for Advanced Therapeutics

The most significant market driver is the inherent and growing demand for advanced therapeutics aimed at treating rare, genetic, and chronic diseases. The rising global recognition and acceptance of personalized medicine have translated into substantial investment from global biotechnology and pharmaceutical firms. The expansion of clinical trial activities particularly in oncology, genetic disorders, and rare diseases has created an urgent and high requirement for scalable, GMP-compliant manufacturing capabilities.

CDMOs are becoming critical strategic partners, as biotech firms seek to enhance scalability and drastically reduce time-to-market. The demand for viral vector manufacturing, a critical component in gene therapies, is escalating, forcing CDMOs to continually invest in complex process development and stringent quality control processes to meet the regulatory agencies’ emphasis on stricter safety standards. For instance, Oxford Biomedica’s extended supply agreement with Novartis to provide lentiviral vectors for CAR-T cell therapies, including Kymriah, exemplifies this core driver.

Expanding Biopharma Collaborations and Funding

The UK’s mature regulatory landscape, strong scientific infrastructure, and world-class research clusters are attracting rising interest from global firms. Biopharma companies are strategically collaborating with CDMOs to access specialized, advanced capabilities without the heavy burden of capital investment.

The need for faster development timelines has cemented outsourcing as an essential strategy. A crucial factor is the flow of Venture capital funding, which is increasingly channeled into biotech start-ups, directly fueling the demand for expert CDMO services to progress their innovative pipelines. Partnerships between academic institutions and CDMOs are increasingly common, designed to efficiently translate early-stage innovations into viable clinical solutions.

A noteworthy collaboration involves Cobra Biologics and Touchlight Genetics, which received an Innovate UK grant to collaborate on next-generation DNA vector (dbDNA™) manufacturing. This partnership leverages advanced enzymatic DNA synthesis with Cobra’s GMP production infrastructure to accelerate manufacturing timelines for the UK and EU gene therapy sectors, perfectly reflecting the strategic value of expanding biopharma collaborations.

Technological Advancements in Manufacturing

The adoption of Technological Advancements in Manufacturing is fundamentally reshaping the market by delivering improvements in efficiency and scalability. The integration of automation and digital monitoring tools into production workflows is enhancing process consistency and reliability. Single-use bioprocessing systems are gaining massive momentum due to their flexibility, cost advantages, and ability to mitigate contamination risk.

Innovations in vector engineering are enabling more precise and effective gene delivery, while advanced analytics and AI-driven quality monitoring are supporting compliance and optimizing batch yields. CDMOs that rapidly adopt these new technologies are gaining a significant competitive edge, attracting global clients who demand state-of-the-art infrastructure. FUJIFILM Diosynth Biotechnologies’ large-scale facility in Billingham, UK, equipped with single-use bioreactors up to 2,000 liters, illustrates the commitment to these technologies.

Rising Regulatory Support and Infrastructure Expansion

The UK government has been proactively instrumental in fostering a favorable policy environment to attract investment in advanced therapies. The strong regulatory frameworks in place ensure that UK CDMOs can meet stringent global quality and safety standards.

Crucially, the expansion of GMP-compliant facilities across the nation is effectively addressing the growing production requirements. Supportive initiatives, coupled with the presence of leading research clusters and innovation hubs, are reinforcing market growth and establishing an environment where companies can efficiently scale therapies from development through to commercialization. This combination of strong Rising Regulatory Support and continuous infrastructure investments is solidifying the UK’s status as a global leader in advanced therapy manufacturing.

Market Trends and Segment Insights

The detailed segmentation by Credence Research Inc. provides clarity on the market’s operational structure and emerging trends.

Digitalization and Personalized Medicine

A significant market trend is the Digitalization of CDMO Operations. The adoption of advanced automation platforms, the deployment of Artificial intelligence to optimize batch monitoring, and the integration of digital twins in bioprocessing are creating intelligent, data-driven manufacturing systems. This enhances real-time scenario testing, improves risk reduction, and allows for simultaneous increases in throughput and compliance.

Furthermore, the Rising Focus on Personalized Medicine is compelling CDMOs to adopt flexible production models. The personalized therapy pipeline, particularly in oncology, requires CDMOs to manage complex logistics for small-batch, customized therapies (like autologous treatments). This trend is fostering deeper partnerships between CDMOs, hospitals, and academic centers to integrate these patient-centric models into clinical workflows.

Regional and Service Dominance

Geographically, England held the largest regional share at 62.4% in 2024, primarily due to its concentration of strong research clusters and numerous advanced GMP facilities. Scotland followed with an 18.7% share, and is notably the fastest-growing subregion, driven by supportive policies and university-linked biotech initiatives.

By service phase, Clinical phase services accounted for the majority, roughly 60% in 2024. This reflects the critical outsourcing demand for large-scale, GMP-compliant production necessary for late-stage trials. Pre-clinical services accounted for the remaining around 40% share, focusing on essential early-stage process development and safety validation that feed the future growth pipeline.

Sustainability and Global Collaborations

The imperative of Sustainability and Green Manufacturing Practices is now a major trend. CDMOs are increasingly adopting green technologies, integrating waste management strategies, and focusing on energy-efficient systems to reduce their carbon footprints. This focus on aligning with international ESG standards is becoming a key factor for multinational clients when selecting a CDMO partner, providing a new benchmark for competitive advantage.

The Growing Global Collaborations and Outsourcing Models confirm the UK as a key hub for international partnership. Global pharmaceutical firms are increasingly leveraging the UK’s specialized CDMO expertise for critical production stages. This cross-border activity accelerates commercialization and strengthens innovation pipelines, underlining how globalization is reshaping CDMO operational models.

The UK Cell and Gene Therapy CDMO Market is experiencing a period of extraordinary expansion, forecast to hit USD 287.57 million by 2032 with a powerful 16.14% CAGR. The market is being fundamentally transformed by the convergence of growing demand for advanced therapeutics, strategic expanding biopharma collaborations, sophisticated technological advancements in manufacturing, and a highly supportive regulatory environment.

For pharmaceutical and biotech companies, CDMOs in the UK are no longer merely contractors but essential strategic enablers, providing the capacity, technology, and compliance expertise required to scale life-saving cell and gene therapies from the lab bench to the patient bedside. Navigating this rapidly evolving landscape requires precise, timely market intelligence a core offering of Credence Research.

Source: https://www.credenceresearch.com/report/uk-cell-and-gene-therapy-cdmo-

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness