What Defines the Market Overview

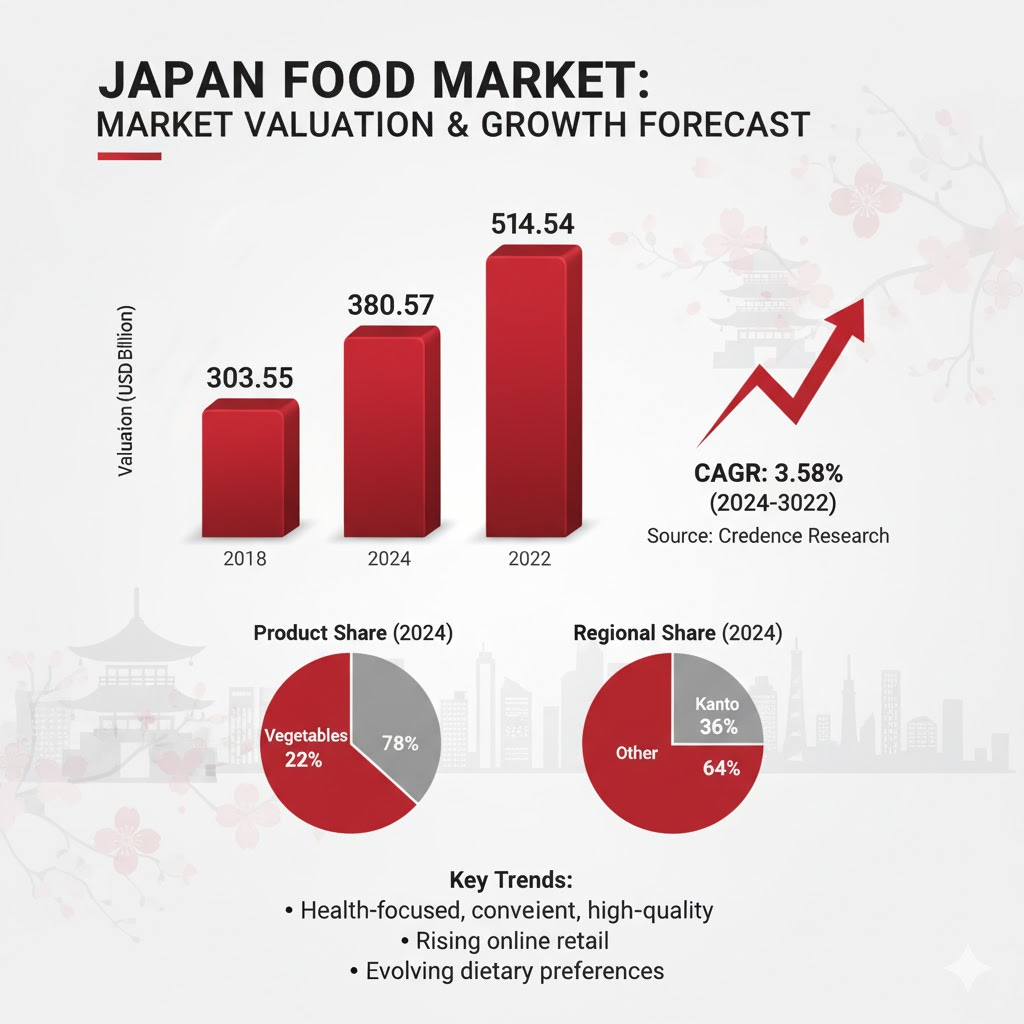

Japan Food Market was valued at USD 303.55 billion in 2018 and grew to USD 380.57 billion in 2024. It is anticipated to reach USD 514.54 billion by 2032, registering a CAGR of 3.58% during the forecast period, as per Credence Research. The market’s growth reflects strong consumer demand for health-focused, convenient, and high-quality food products. Rising online retail activity and evolving dietary preferences are reshaping distribution and product strategies. Vegetables lead product share at roughly 22%, while Kanto dominates regionally with a 36% share. Leading domestic and international firms continue to invest in innovation, sustainable sourcing, and premium offerings to strengthen competitiveness.

For more: https://www.credenceresearch.com/report/japan-food-market

What Drives the Market Growth

Health-First Consumer Preferences

Rising consumer focus on nutrition and balanced diets boosts demand for fresh produce, dairy alternatives, and low-sodium or high-protein products. Japan Food Market benefits from government nutrition initiatives and higher uptake of premium, health-oriented SKUs. Manufacturers respond with reformulated recipes, targeted product lines, and clearer labeling to capture health-conscious spend.

Convenience and Digital Channel Expansion

Urban lifestyles and an aging population increase demand for ready-to-eat and convenience foods while online retail expands access. It drives faster product rotation, stronger direct-to-consumer models, and partnerships between retailers and delivery platforms, improving reach to time-pressed households and supporting category growth.

Where Trends and Opportunities Emerge

E-commerce and Digital Transformation

Online retail penetration gains momentum, offering subscription and home-delivery models that broaden reach and capture younger, urban shoppers. Japan Food Market sees opportunities in data-driven assortment, cold-chain logistics, and omnichannel fulfillment to serve demand for fresh and convenience items.

Sustainability and Product Innovation

Sustainability pressures push firms toward recyclable packaging, reduced plastic use, and transparent sourcing. It opens room for premium regional specialties and export-driven product lines that leverage Japan’s food-safety reputation and culinary premiumization to access overseas markets.

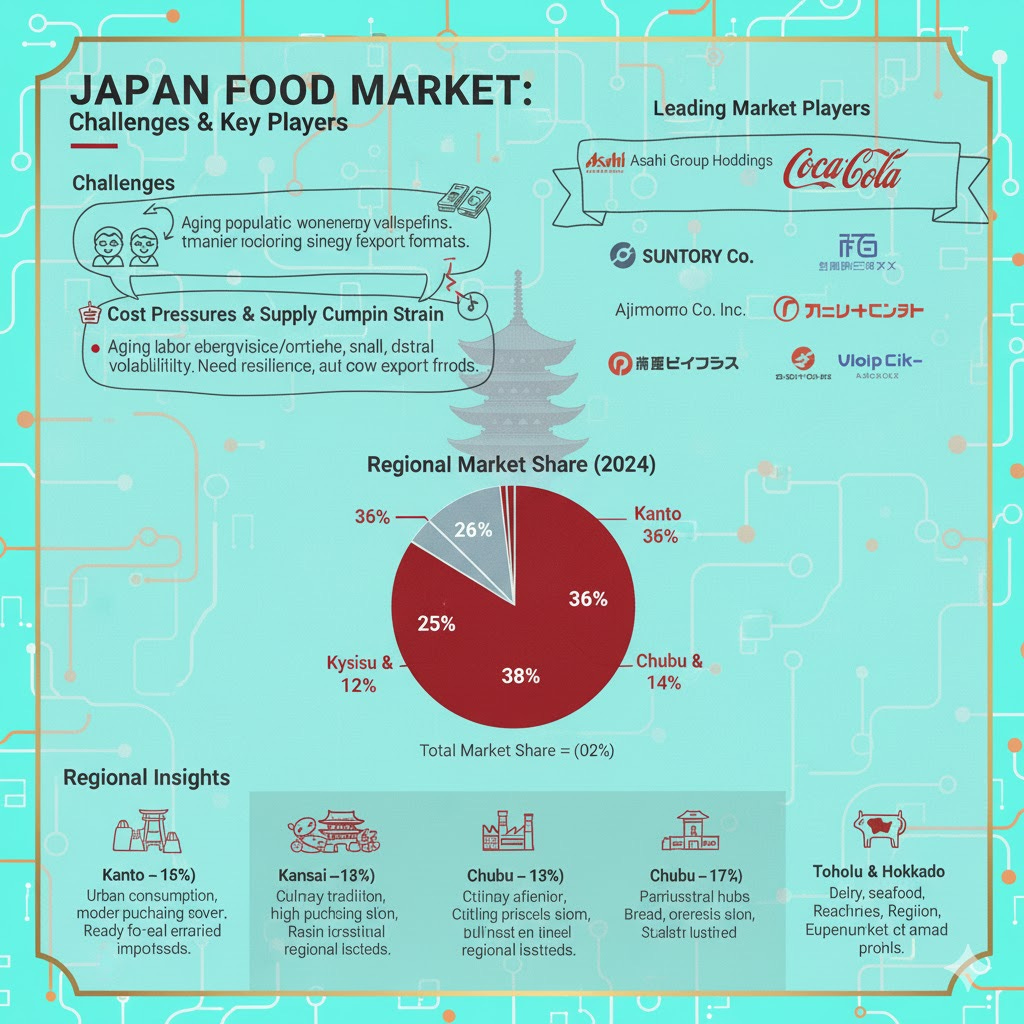

Which Challenges Shape the Market

Demographic Headwinds and Consumption Shifts

Japan’s aging population and low birth rate constrain long-term volume growth and change consumption toward smaller portions and health-focused formats. The Japan Food Market must pivot product portfolios and pursue niche segments or export growth to offset domestic demographic limits.

Cost Pressures and Supply Chain Strain

Rising labor, energy, and raw material costs raise operating expenses and compress margins. Imported commodity exposure and currency volatility increase procurement risk. Companies must strengthen supply-chain resilience, adopt automation, and optimize distribution to sustain competitiveness.

Who Leads the Market

Asahi Group Holdings

Hanwa Co., Ltd.

Suntory Group

Meiji Holdings Co., Ltd.

Ajinomoto Co., Inc.

Yamazaki Baking Co., Ltd.

Maruha Nichiro Corporation

Coca-Cola (Japan operations)

Associated British Foods PLC

General Mills Inc.

How Regions Perform (Regional Insights)

Kanto — 36%

Kanto, led by Tokyo, drives premium and convenience demand through dense urban consumption, modern retail networks, and high purchasing power that favor ready-to-eat and imported specialty foods.

Kansai — 22%

Kansai combines strong culinary tradition and tourism to sustain demand for seafood, confectionery, and regional specialties, supporting retail innovation and food-service growth.

Chubu — 18%

Chubu’s industrial hubs increase demand for bread, cereals, and meat; strong supermarket presence and supply-chain centrality support distribution and processed-food manufacturing.

Kyushu & Okinawa — 14%

Kyushu & Okinawa rely on agriculture and fisheries, with tourism boosting ethnic and ready-to-eat food demand and strengthening regional specialty exports.

Tohoku & Hokkaido — 10%

Tohoku and Hokkaido supply dairy, seafood, and produce; agricultural strength sustains regional processing and niche product growth despite population decline.

How Competition Evolves

The Japan Food Market shows intense competition between domestic conglomerates and multinational brands; leaders include Asahi Group, Suntory, Meiji Holdings, Ajinomoto, Yamazaki Baking, and Maruha Nichiro. It relies on brand equity, broad retail partnerships, and innovation in healthier and convenience categories. Firms pursue R&D, strategic M&A, and export expansion to protect margins and scale. Distribution alliances with supermarkets, convenience store chains, and e-commerce platforms remain key to maintaining market share.

How Companies Enter the Market

To capture growth in the Japan Food Market, firms should segment offerings by health, convenience, and premium value, align SKUs to regional tastes, and secure distribution with major supermarket and convenience chains. It must deploy localized digital campaigns, partner with logistics providers for cold-chain reliability, and pilot subscription and direct-to-consumer channels. Strategic collaborations with retailers and targeted export initiatives will expand reach and offset domestic demographic constraints.

What’s New in the Industry

Asahi Soft Drinks began producing large bottles from chemically recycled resin in April 2022.

Rakuten expanded fulfillment capacity for Rakuten Mart in August 2024 to support high-volume order handling.

Starbucks Japan launched seasonal product innovations (e.g., Marrone “Cassis Frappuccino”) in August 2022.

Domino’s Japan reached its 900th store milestone in March 2022, reflecting food-service expansion.

Seven & i Holdings announced store closures and network adjustments for Ito-Yokado, reflecting retail restructuring in 2023–2024.

What Lies Ahead

The Japan Food Market will shift toward higher-value health and convenience products while digital channels expand reach. Export growth will offset domestic demographic limits and support revenue diversification. Sustainability and supply-chain resilience will shape investment priorities, and leaders will compete through product innovation, retail partnerships, and targeted exports to maintain growth momentum.

For more: https://www.credenceresearch.com/report/japan-food-market