The Ascent of Spanish Agriculture: Analyzing the Spain Fungicides Market Poised for $1.1 Billion by 2032

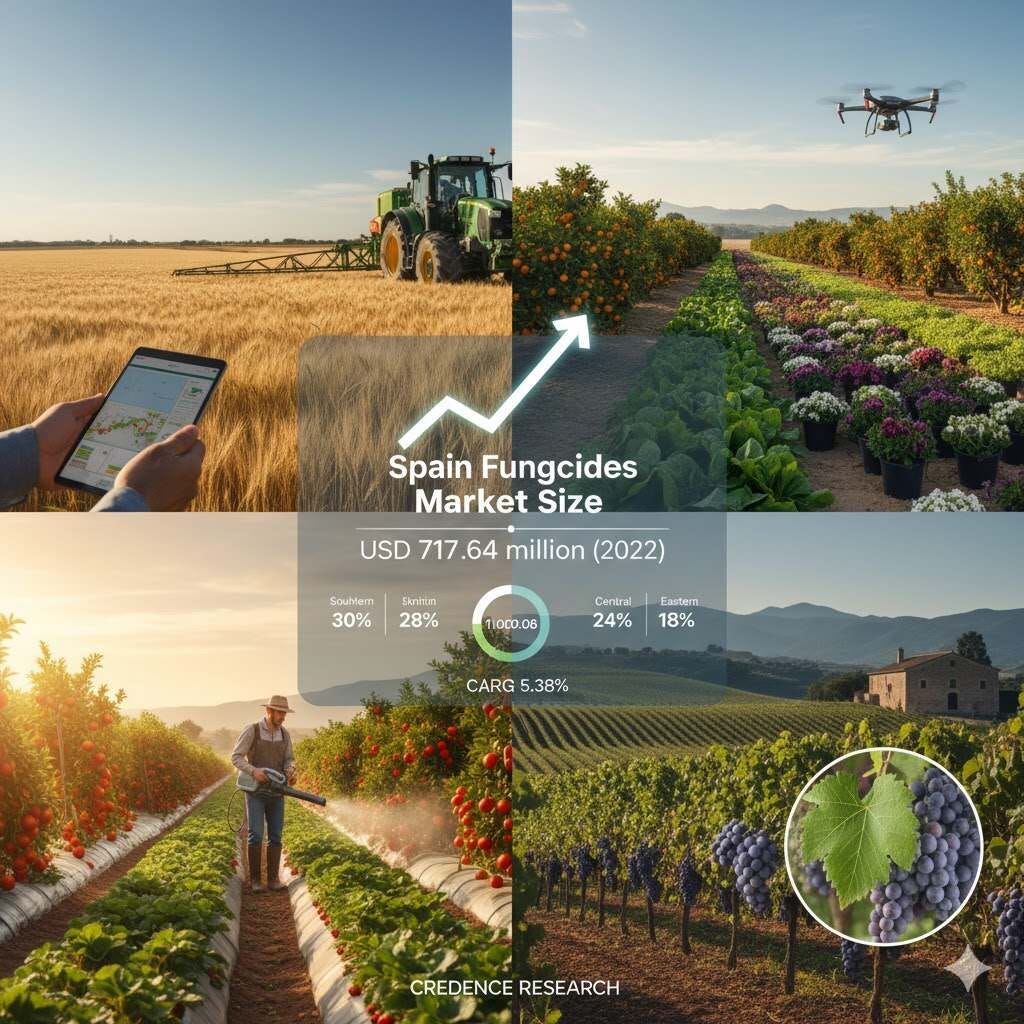

The agricultural sector in Spain, a powerhouse of European food production, is undergoing a profound transformation, one heavily influenced by technological advancements and increasingly stringent environmental standards. At the core of sustaining Spain’s intensive cultivation practices is the Spain Fungicides Market, a segment that has demonstrated impressive resilience and consistent growth. According to a detailed market analysis by Credence Research, this vital market was valued at USD 717.64 million in the base year of 2024, building on a strong foundation from USD 517.05 million recorded in 2018. Looking ahead, the trajectory is steeper, with the market confidently anticipated to breach the billion-dollar mark, projecting a size of USD 1,100.08 million by the end of the forecast period in 2032. This substantial growth is underpinned by a robust Compound Annual Growth Rate (CAGR Spain fungicides) of 5.38% between 2025 and 2032, highlighting the indispensable nature of disease control in modern Spanish farming.

Source: https://www.credenceresearch.com/report/spain-fungicides-market

Market Dynamics and the Drive for Sustainable Growth

The consistent historical growth, evident in the transition from 2018 to the current market valuation in 2024, is not accidental. It is a direct result of several converging market drivers specific to the Spain agrochemicals landscape. Spain’s position as Europe’s primary supplier of fresh produce necessitates high-yield, high-quality output, which in turn demands effective crop protection. Fungal diseases, endemic to many high-value crops like vines, fruits, and vegetables, pose a continuous threat to this productivity. The reliance on advanced fungicides, both synthetic and biological, has been key to securing stable harvests.

A defining characteristic of the modern Spain Fungicides Market is the dual focus on efficacy and sustainability. The European Union’s regulatory framework, particularly the drive toward minimizing chemical residues and promoting Integrated Pest Management (IPM), has been a powerful catalyst for innovation. Companies operating within Spain must demonstrate compliance with EU regulations fungicides, leading to a noticeable shift in product development. This regulatory environment has pushed manufacturers to evolve their extensive product portfolios, favoring newer, safer chemistries and, most significantly, fostering rapid adoption of bio-fungicides Spain. These biological solutions offer growers alternatives that align with consumer demand for sustainably grown food, driving premium growth within the market segment. The Historical Period analyzed by Credence Research (2020-2023) captures a period where these regulatory pressures and subsequent product innovations solidified the market’s expansion.

The Future Forecast: Tapping into a $1.1 Billion Opportunity

The fungicides market forecast up to 2032 paints an optimistic picture, predicting an additional growth of nearly $400 million. This projected surge is driven by several macroeconomic and agricultural trends:

-

Innovation in Bio-fungicides and Novel Chemistries: The CAGR Spain fungicides of 5.38% is indicative of the continued technological advancement. Investments in research and development are yielding more potent and environmentally benign products. The Spanish market is becoming a showcase for the successful integration of biological controls, with bio-fungicides Spain moving from niche products to mainstream crop protection tools. This trend allows farmers to maintain effective disease control while meeting the demanding standards of the EU Green Deal.

-

Expansion of Export-Oriented Cultivation: A significant portion of Spain’s agricultural output, particularly from the southern regions, is destined for export, which demands impeccable quality standards often achievable only through precise disease management. As global food demand grows, and Spain strengthens its position as a reliable supplier, the need for advanced fungicidal treatments will correspondingly escalate.

-

Climate Change and Disease Pressure: Increasingly erratic weather patterns and warmer temperatures in the Mediterranean basin create ideal conditions for fungal proliferation. This environmental pressure ensures that the demand for fungicides remains non-negotiable for Spanish farmers seeking to mitigate crop losses from diseases like mildew, rusts, and blights. Therefore, the Fungicides Market Size Spain is intrinsically linked to climate-driven disease incidence.

Competitive Dynamics: Giants and Specialists in the Landscape

The Spain Fungicides Market is characterized by the powerful presence of global agrochemical leaders. The market is currently spearheaded by major international players, including Syngenta, Bayer CropScience, BASF SE, FMC Corporation, Dow AgroSciences, Adama, and Nufarm. Their dominance is rooted in massive R&D capabilities, which allow them to introduce innovative products rapidly, and their well-established distribution networks across the diverse agricultural regions of Spain.

Local expertise is also critical, with companies like Sipcam Iberica, Atanor, and Indukern playing vital roles. These specialized firms often excel at tailoring products to specific Spanish crop protection needs and managing the complexities of local registration and field trials. The competitive advantage among these players is often gained not just through the chemical composition of their products but also through sophisticated service offerings, including digital farming tools that guide farmers on optimal application timing and dosage. This ensures not only efficiency but also compliance with strict residue limits governed by EU regulations fungicides. The continuous battle for market share fuels the innovation that underpins the forecast growth towards USD 1,100.08 million by 2032.

Regional Segmentation: The Mosaic of Spanish Agricultural Demand

The consumption pattern of fungicides in Spain is highly segmented, reflecting the distinct agricultural specializations across the Iberian Peninsula. This regional distribution is crucial for understanding the Fungicides Market Size Spain and is a key focus of the report by Credence Research.

Southern Spain: The Engine of Horticulture

Southern Spain commands the largest share of the market, accounting for a significant 30%. This dominance is driven by the region’s intense, often protected, fruit and vegetable cultivation Spain. Regions like Andalusia, often referred to as Europe’s ‘horticultural engine,’ specialize in crops like strawberries, peppers, tomatoes, and citrus fruits. These crops, grown for high-value export markets, are particularly vulnerable to fungal pathogens, necessitating year-round preventive and curative fungicidal treatments to guarantee the necessary aesthetic and sanitary quality standards. The economic incentive to protect this export-oriented produce is the primary factor solidifying the region’s market lead.

Northern Spain: The Vineyard’s Shield

Following closely, Northern Spain contributes 28% to the overall market. The market here is distinctively shaped by its strong viticulture sector. The need for viticulture fungicides is paramount, as grapes are highly susceptible to diseases such as powdery mildew, downy mildew, and Botrytis cinerea. This region, home to Spain’s most famous wine-producing areas, demands high-quality, specialized products that effectively protect the valuable grape crops without impacting the fermentation process or final wine quality. The consistent investment in vineyard protection ensures a stable demand for high-end fungicidal solutions.

Central and Eastern Spain: Cereals, Citrus, and Ornamentals

Central Spain, anchored by the production of cereals and grains, accounts for 24% of the market. While field crops typically require less intensive fungicidal input than high-value horticulture, the large acreage under cultivation ensures substantial volume demand for products targeting rusts and smuts.

Finally, Eastern Spain captures the remaining 18%, focusing on citrus, vegetables, and ornamentals. This region shares a similar high-value crop profile to the South, but with a greater specialization in specific citrus varieties and a flourishing ornamental plant sector, both of which require dedicated and sensitive disease control programs.

Strategic Imperatives for the Fungicides Market

The analysis of the Spain Fungicides Market reveals a highly dynamic, yet fundamentally robust, industry poised for significant expansion, evidenced by the forecast to reach USD 1,100.08 million by 2032. The market’s growth is being strategically channeled by two forces: the relentless pursuit of higher crop yields to service demanding export markets, and the mandatory pivot towards sustainable, residue-reducing solutions driven by EU regulations fungicides.

For key players like Syngenta, Bayer CropScience, and BASF SE, success in this market will increasingly depend on their ability to deliver advanced bio-fungicides Spain and precision application technologies. The detailed insights provided by Credence Research underscore that the future profitability of this market lies in understanding the complex regional crop profiles from fruit and vegetable cultivation Spain in the South to the specialized viticulture fungicides in the North and aligning product strategies with both economic necessity and environmental stewardship. The Spanish agrochemicals sector is not merely growing; it is strategically evolving to become a leader in sustainable crop protection.

Source: https://www.credenceresearch.com/report/spain-fungicides-market

- Business

- Research

- Energy

- Art

- Causes

- Tech

- Crafts

- crypto

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness